2020 Nevada Sales Tax Form

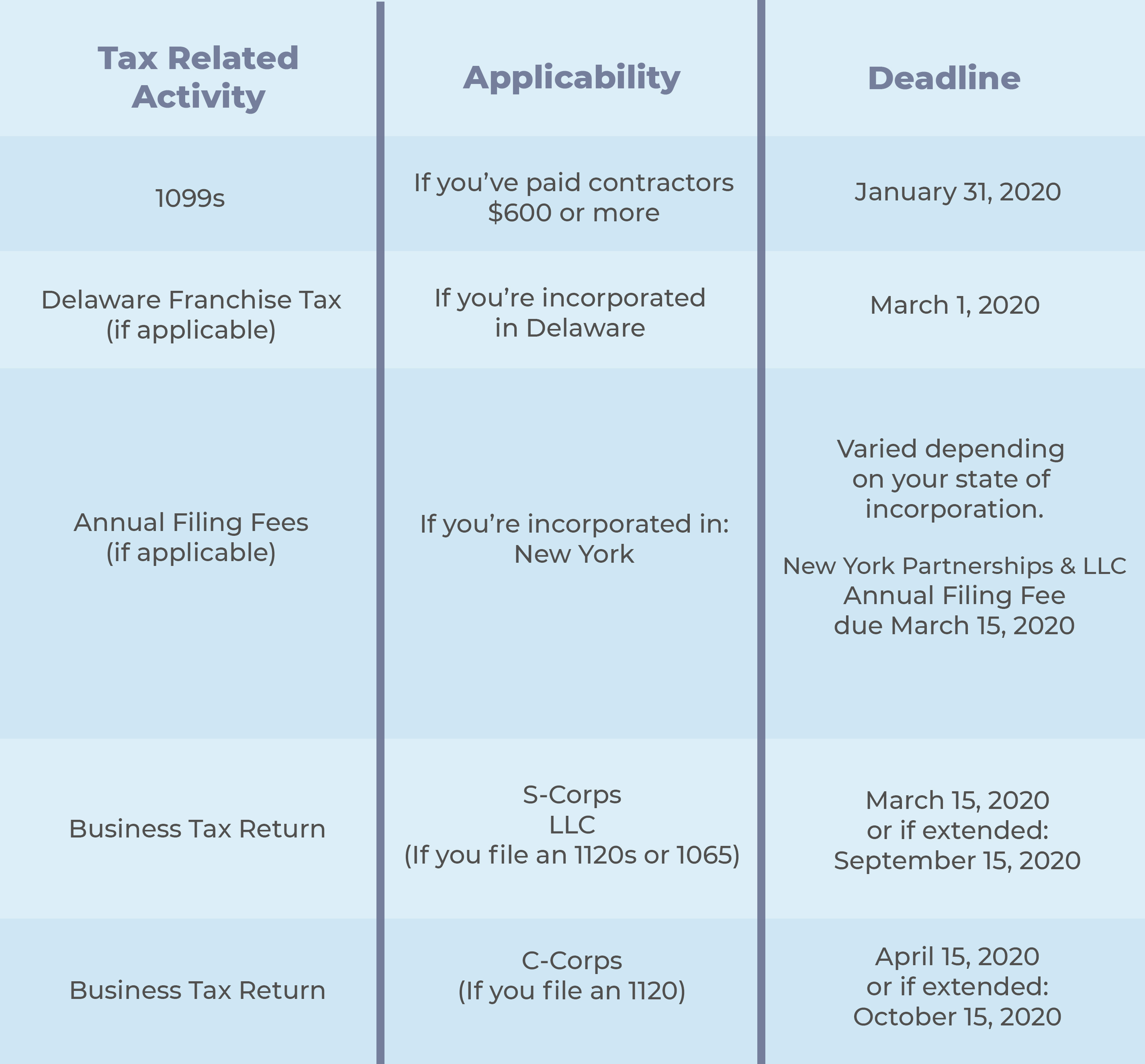

How 2020 Sales taxes are calculated in Las Vegas. The Las Vegas, Nevada, general sales tax rate is 4.6%. Depending on the zipcode, the sales tax rate of Las Vegas may vary from 8.25% to 8.375% Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (3.65% to 3.775%). There is no city sale tax for ...

Tax returns and forms for Nevada-based fuel dealers and suppliers. Fuel Dealers & Suppliers. On this Page ... Gasoline Tax Refund Request Form (MC 045g) Gasoline Tax Refund Request Instructions (MC 045g) ... 2020: January 2020: March 2, 2020: February 2020: March 31, 2020: March 2020: April 30, 2020:

Quarterly filer forms (Form ST-100 series)

Quarterly Schedule FR - Sales and Use Tax on Qualified Motor Fuel and Highway Diesel Motor Fuel: ST-100.13 : Instructions on form: Quarterly Schedule E - Paper Carryout Bag Reduction Fee: 1st quarter: March 1, 2020 - May 31, 2020 Due date: Monday, June 22, 2020; ST-100: ST-100-I (Instructions)Example 1: If $100 worth of books is purchased from an online retailer and no sales tax is collected, the buyer would become liable to pay Nevada a total of $100 × 6.85% = $6.85 in use tax. Example 2: If a $10,000 boat is purchased tax-free and then brought into a jurisdiction with a 4.85% sales tax rate, the buyer would become liable to pay Nevada a total of (6.85% - 4.85%) × $10,000 = $685 ...

Nevada Sales Tax By County

2020 Nevada Sales Tax By County Nevada has 249 cities, counties, and special districts that collect a local sales tax in addition to the Nevada state sales tax . Click any locality for a full breakdown of local property taxes, or visit our Nevada sales tax calculator to lookup local rates by zip code.Taxes - Sales and Use Tax

Jun 20, 2020 · Taxes Site - Sales and Use Tax. COVID-19 Updates for Sales and Use Tax. State of Michigan 2020 Sales and Use Tax Return (February, March, April, May monthly periods and first quarter return period) filing deadline is June 20, 2020.. Extensions offered for filing 2020 nevada sales tax form deadlines are not applicable to Accelerated Sales and Use Tax payments.Texas Sales and Use Tax Forms

01-790, 2018 Worksheet for Completing the Sales and Use Tax Return Forms 01-114, 01-115, and 01-116 (PDF) 01-797, 2018 Worksheet for Completing the Sales and Use Tax Return Form 01-117 (PDF) Refund Forms. Sales Tax Refund Instructions (PDF) 00-985, Assignment of Right to Refund (PDF)NEVADA - Where to File Addresses Taxpayers and Tax ...

Jan 08, 2020 · These Where to File addresses are to be used ONLY by TAXPAYERS AND TAX PROFESSIONALS 2020 nevada sales tax form filing individual federal tax returns in Nevada during Calendar Year 2020. If you live in NEVADA ... and you are filing a Form ... and you ARE NOT ENCLOSING ASales & Use Tax | Forms & Instructions | Department of ...

Retail Sales Tax CR 0100AP- Business Application for Sales Tax Account DR 0100 - Retail Sales Tax Return for 2020 Filing Periods (Supplemental Instructions) DR 0100A- 2020 nevada sales tax form Retail Sales Tax … louis vuitton lock pendant necklace goldRECENT POSTS:

- multi pochette louis vuitton review

- louis vuitton musette tango review

- used metis louis vuitton

- louis vuitton monogram cerises speedy 2500

- ski resort st louis

- louis vuitton reverse monogram mini boite chapeau

- louis vuitton men's accessories 2018-19

- gucci crossbody bags black

- louis vuitton belts real

- louise girl name meaning

- lv bag black monogram

- louis vuitton stores in los angeles

- louis vuitton blogger bag

- cartera louis vuitton original precio peru

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

authenticity check louis vuitton keepall

louis vuitton made in france o spain

louis vuitton supreme jean shirts

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the date code louis vuitton neverfull pm for more info.