Amazon Sales Tax Rate Nevada

Nevada Sales Tax Rate - 2020

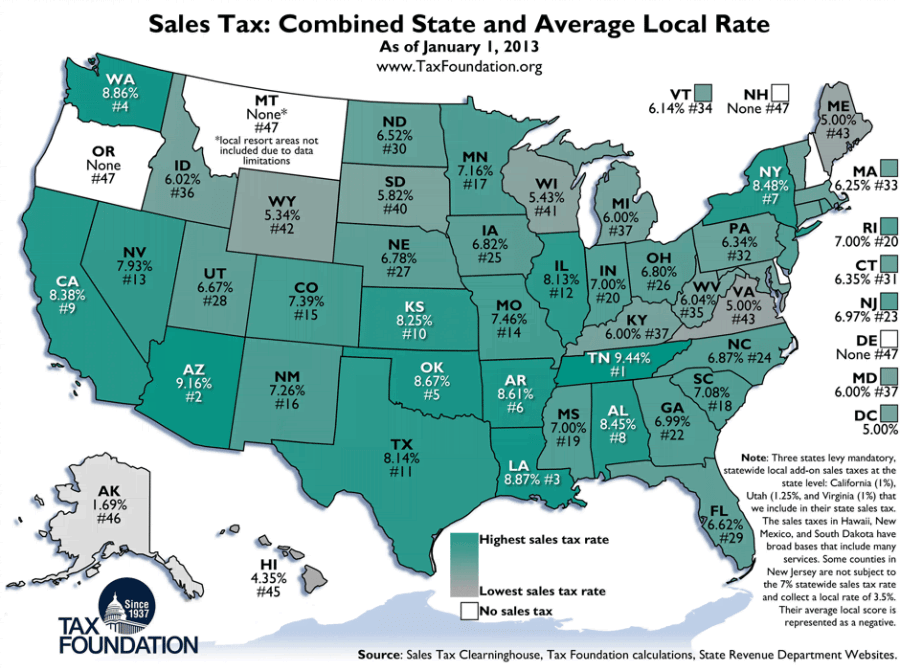

The Nevada state sales tax rate is 6.85%, and the average NV sales tax after local surtaxes is 7.94%.. Groceries and prescription drugs are exempt from the Nevada sales tax; Counties and cities can charge an additional local sales tax of up to 1.25%, for a maximum possible combined sales tax of 8.1%; Nevada has 249 special sales tax jurisdictions with local sales …Sales Tax By State: Are Grocery Items Taxable?TaxJar Blog

Alaska – grocery items are tax exempt. Arizona – grocery items are tax exempt. Arkansas – Grocery items are not tax exempt, but food and food ingredients are taxed at a reduced Arkansas state rate of 1.5% + any local rate. (Search local rates at TaxJar’s Sales Tax Calculator.)Any food items ineligible for the reduced rate are taxed at the regular amazon sales tax rate nevada state rate.Mar 29, 2017 · "Whatever amazon sales tax rate nevada a state is getting in sales tax from Amazon, it should probably be getting about twice that much," said Behlke. CNNMoney (New York) First published March 29, 2017: 2:59 PM ET.

Sep 22, 2020 · AWS charges US sales tax for certain AWS services where applicable. For information about AWS US sales tax policies and practices, see Tax help – United States.. If you're amazon sales tax rate nevada tax-exempt in a particular state, open a case in the Support Center.Then, attach an electronic copy of your valid tax …

Note: Amazon Payments, Checkout by Amazon, Fulfillment by Amazon, and tax calculation service fees are not affected by this change. Sales made to sellers with an EU VAT registration number may be …

State Sales Tax Rates - Sales Tax Institute

0% – 2.5% Some local jurisdictions do not impose a sales tax. Yes. Nevada: 6.85% The Nevada Minimum Statewide Tax rate of 6.85% consists of several taxes combined: Two state taxes apply — 2.00% Sales Tax and the 2.6% Local School Support Tax which equal the state rate …Sales Ranking; Getting Paid; Tax Information. Tax Information Requirements; Tax Forms; Tax Account Status; Tax Interview; Tax Withholding. Kindle Store: BR - BR Tax Withholding; AU & IN Goods and Services Tax; Taiwan VAT; Applying for a U.S. TIN (Taxpayer ID Number) Applying for a U.S. EIN for Corporations and Non-Individual Entities; Tax …

Why Amazon paid no federal income tax - CNBC

Apr 03, 2019 · In 2018, Amazon paid $0 in U.S. federal income tax on more than $11 billion in profits before taxes. It also received a $129 million tax rebate from the federal government. Amazon's low tax …Request ADA document remediation for individuals using assistive technology devices archlight lv shoes

RECENT POSTS:

- lv pochette felicie damier azur

- ioffer louis vuitton makeup bag

- simplicity crossbody bag pattern

- louis vuitton neverfull gm damier azur tote bag

- eu louis vuitton prices

- can i buy chanel handbag online

- post dispatch st louis cardinals

- louis vuitton leather wrist strappy

- airpods louis vuitton price

- wholesale ladies cotton handbags

- dolce gabbana light blue duffle bag

- louis vuitton store looted in us

- louis vuitton aftergame sneaker gold

- nike leather wallets for men

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

black patent leather tote handbags

outlet louis vuitton lv belts lvmbelts-3588

coupon code for st louis cardinals tickets

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton empreinte montaigne mm poppy for more info.