Clark County Nevada Sales Tax 2018

Real Property Tax Due Dates : For Fiscal Year 2018-2019 (July 1, 2018 to June 30, 2019) Installment Due Date Last Day to Pay without Penalty; 1st: Monday August 20, 2018: August 30, 2018: 2nd: Monday October 1, 2018: October 11, 2018: 3rd: Monday January 7, 2019:

Upon payment of all taxes and costs, the county will reconvey the real property back to the owner. The Tax Lien Sale. In most counties in Nevada, tax lien sales are handled like auctions. This article covers the basics as well as specifics for Washoe and Clark Counties. The remaining counties in Nevada will be covered in a separate article.

Clark County approves raising sales tax 1/8 of a cent ...

Sep 03, 2019 · The tax increase will take the sales tax in Clark County from 8.25 percent to 8.375 percent. The bill allows money to be used to address homelessness, prevent truancy and chronic absenteeism in school, promote early childhood education, affordable housing, workforce development, and aid in recruitment and retaining teachers in high-risk schools.State: Excise tax money clark county nevada sales tax 2018 now going to schools. In May, lawmakers introduced Senate Bill 545, which proposes moving all money collected from the state’s 10% excise sales tax on marijuana to education.

Nevada Income Tax Calculator - SmartAsset

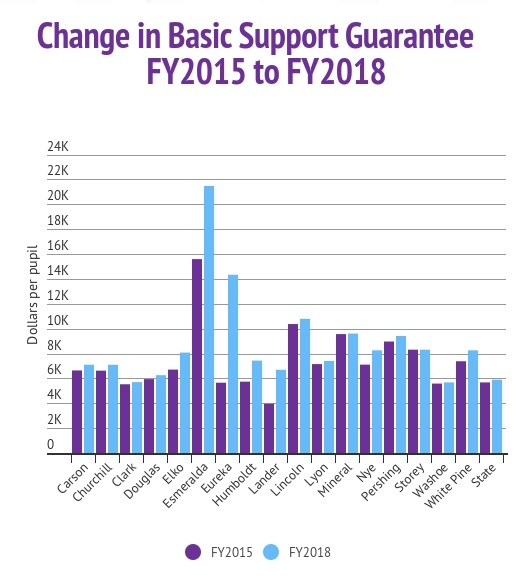

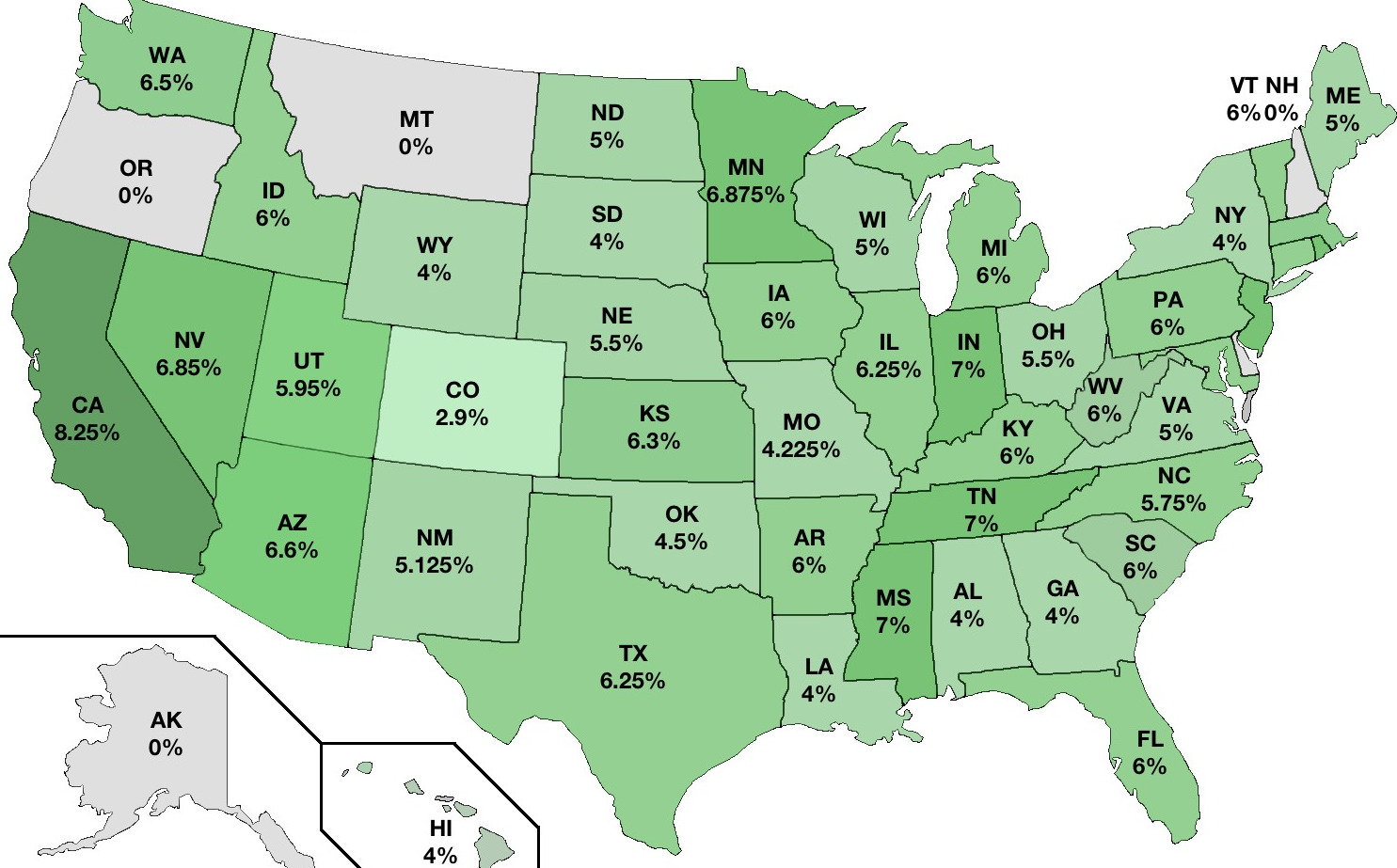

Of course, you must still pay federal income taxes. Nevada Sales Tax. Nevada’s statewide sales tax rate of 6.85% is seventh-highest in the U.S. Local sales tax rates can raise the sales tax up to 8.265%. The table below shows the county and city rates for every county and the largest cities in the state.Nevada Sales Tax Rate - 2020

The Nevada state sales tax rate is 6.85%, and the average NV sales tax after local surtaxes is 7.94%.. Groceries and prescription drugs are exempt from the Nevada sales tax; Counties and cities can charge an additional local sales tax of up to 1.25%, for a maximum possible combined sales tax of 8.1%; Nevada has 249 special sales tax jurisdictions with local sales taxes in addition to the state ...Find and bid on Residential Real Estate in Clark County, NV. Search our database of Clark County Property Auctions for free!

Jan 01, 2020 · The Department is now accepting credit card payments in Nevada Tax (OLT). Click Here for details.; NEW! Click here to schedule an appointment; Clark County Tax Rate Increase - …

Fuel Dealers & Suppliers - Nevada Department of Motor Vehicles

County Gasoline/Gasohol County Option* Gasoline/Gasohol County Other* Gasoline/Gasohol County Index* Diesel/Biodiesel County Option* Diesel/Biodiesel/LNG County Index* CNG* County Index LPG* County Index A-55* County Index; Carson City : 0.09 : 0.01 : 0.05 effective 8-1-2020 : Churchill : 0.09 : 0.01 : Clark : 0.09 : 0.01: PPI $0.1483505 : PPI ...RECENT POSTS:

- designer denim handbags on sale

- best amazon black friday deals uk

- black friday tv deals walmart 2020

- ski resorts st louis missouri

- womens black tennis shoes on sale

- louis vuitton neverfull gm gebraucht kaufen

- iphone 11 pro max lv supreme cases

- world map pictures for sale

- lv v tote mm reviewed

- sling purse backpack

- where is authentic louis vuitton made

- triple a louis vuitton

- epicardial lv lead placement

- wholesale apparel in new york

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

gucci marmont mini round shoulder bag review

how to tell if fake louis vuitton bag

st louis cardinals baseball schedule for tv

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the hermes birkin bag price range for more info.