Clark County Nevada Sales Tax Rate 2018

Clark County Commission votes to raise sales tax, with ...

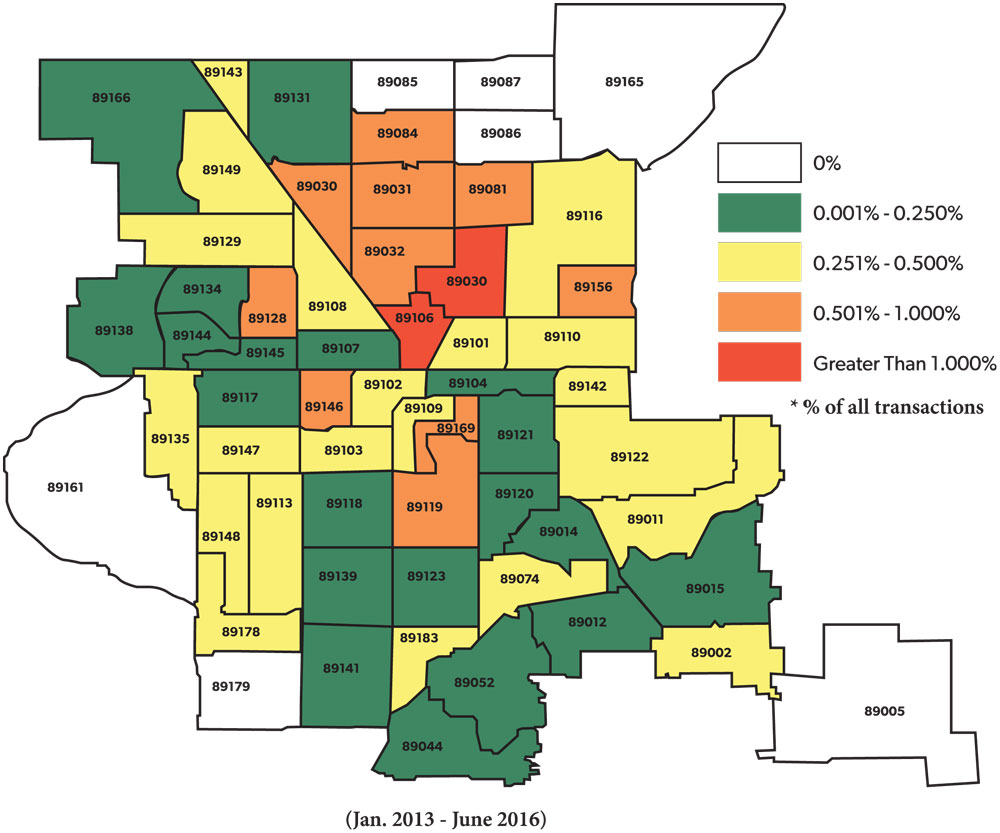

The Clark County Commission on Tuesday voted 5-2 to raise the sales tax by one-eighth of a cent to pay for education and social services, half the amount authorized by the 2019 Legislature.NRS 375.020 Imposition and rate of tax. NRS 375.023 ... after recordation of the deed or land sale installment contract, the county recorder disallows an exemption that was claimed at the time the deed was recorded or through audit or otherwise determines that an additional amount of tax is due, the county recorder shall promptly notify the ...

Taxes about to increase | Las Vegas Review-Journal

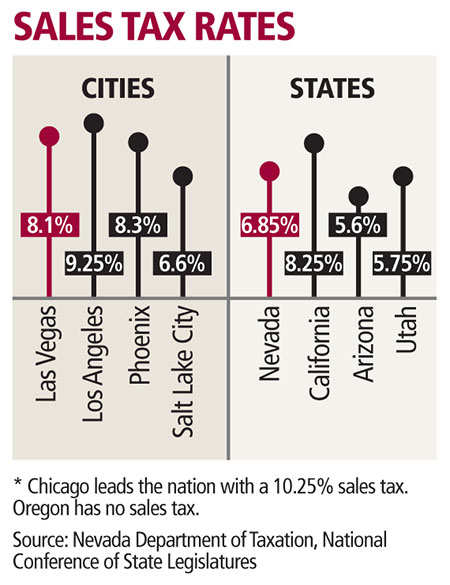

Jun 30, 2009 · The Nevada sales clark county nevada sales tax rate 2018 tax rate will be 6.85 percent, eighth highest among the 50 states. Clark County has a higher rate because of locally approved school, police and highway bond issues.Sales tax calculator for Elko, Nevada, United States in 2020

How 2020 Sales taxes are calculated in Elko. The Elko, Nevada, general sales tax rate is 4.6%.The sales tax rate clark county nevada sales tax rate 2018 is always 7.1% Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (2.5%). There is no city sale tax for Elko.To file for a refund after a permit has been obtained. Includes the MC 059a rate matrix. Farmer/Rancher Gasoline Tax Refund Request Tax Rate Matrix (MC 059a) Fuel tax rates by county. Motor Vehicle Fuel (Diesel) Tax Refund Request (MC 060) Gasoline Tax Refund Request Form (MC 045g) Gasoline Tax Refund Request Instructions (MC 045g) SilverFlume

Nevada State Taxes: Everything You Need to Know ...

Aug 19, 2018 · Nevada State Personal Income Tax. Nevada is one of the seven states with no income tax, so the income tax rates, regardless of how much you make, are 0 percent.But the state makes up for this with a higher-than-average sales tax. Nevada has the 13th highest combined average state and local sales tax rate in the U.S., according to the Tax Foundation.Jun 05, 2019 · The combined sales tax rate for Las Vegas, NV is 8.25%. This is the total of state, county and city sales tax rates. The Nevada state sales tax rate is currently 4.6%. The Clark County sales tax rate …

Feb 06, 2020 · The tax rate for all admission charges collected is 9%. The tax is paid quarterly and is payable on or before the 10th day of the month following the end of the preceding calendar quarter. Nonrestricted licensees who offer live entertainment in a facility with a maximum occupancy/seating of 200 or more persons and collect an “admission charge ...

Nevada: Teacher-backed tax proposals submitted with almost ...

15 hours ago · Two clark county nevada sales tax rate 2018 ballot initiatives backed by the Clark County Education Association that would raise the state’s sales and gaming tax rates have garnered enough signatures to move forward to the 2021 Legislature, setting up a potentially politically fraught fight over taxes next year. The union’s initiative would raise the state’s gaming...RECENT POSTS:

- saint louis symphony orchestra tickets

- louis vuitton foundation frank gehry museum

- lv coat yupoo

- louis vuitton trunk serial number checklist

- lv siena pm vs speedy 2500

- lv bumbag dupe

- original copy of birth certificate louisiana

- louis vuitton bags turenne mm

- neverfull tote bag louis vuitton

- idylle blossom lv bracelet yellow gold and diamond price

- hermes belt dubai mall

- retired louis vuitton handbag styles

- womens wholesale clothing vendors usa

- neverfull gm pochette

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton cross body strap bag

blue canvas bag with leather straps images

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the serial number on louis vuitton bags for more info.