Clark County Wa Sales Tax Rate 2018

Clark County fuel tax increase passes by double-digit ...

By a double-digit margin, Clark County voters were poised to approve a decade-long incremental county fuel tax hike that will see them paying more at the pump to fund nearly 200 roadway projects.Clark County homeowners take a hit as property taxes pile ...

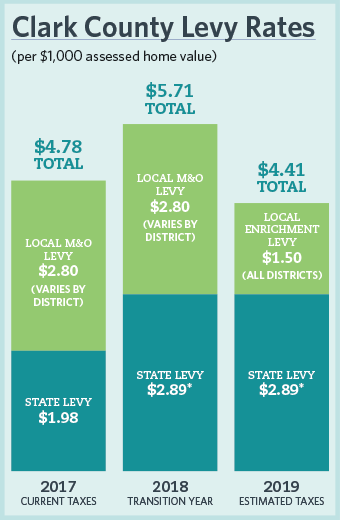

Apr 30, 2018 · Property owners across Clark County saw tax rate increases ranging from 42 cents per $1,000 in assessed value in Vancouver city limits, to $2.76 per $1,000 in assessed value in rural north Clark ...Sales Tax Map. This also includes an alphabetical list of Nevada cities and counties, to help you determine the correct tax rate. 8.375%Tax Rate Sheet. For use in Clark County effecitve 1/1/2020. 8.25% Tax Rate Sheet ... For use in Clark county effective 1/1/2016 through 03/31/2017 how do you say louis vuitton in french

CLARK COUNTY TAX RATES A tax district is an area defined within a county for taxing purposes. There are currently 111 separate tax districts in Clark County. The tax rate for each district is based on the amount of monies budgeted for government-provided services, such as schools, police, fire, parks, libraries, and capital projects, such as flood control and transportation.

List must be prepared in order by tax bill number, lowest to highest. July: Last day for each third party purchaser to register with clark county wa sales tax rate 2018 the county clerk to participate in clerk’s sale of priority or current year certificates of delinquency.

Vancouver, WA Sales Tax Rate

Jul 01, 2020 · The clark county wa sales tax rate 2018 latest sales tax rate for Vancouver, WA. This rate includes any state, county, city, and local sales taxes. 2019 rates included for use while preparing your income tax deduction.Oregon vs Washington Taxes - Vancouver WA Homes for Sale ...

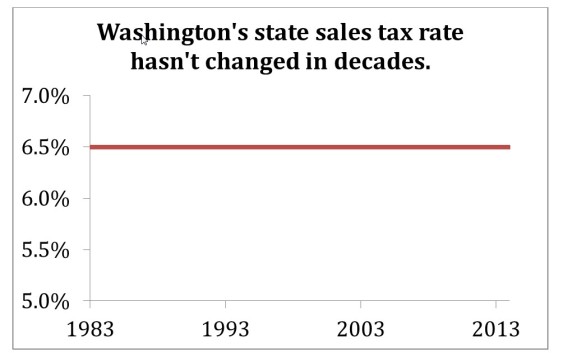

State & Local Retail Sales Tax: State Rate 6.5% Vancouver Rate 1.9% Total: 8.4 %: None: Transit District Tax: 0.3% (Included in the 8.4% sales tax) 0.62% flat rate payroll tax. Real and Personal Property Tax: $13.73 average rate per $1,000 of assessed value 1.28% Real Estate Excise Tax: $19.07 average rate per $1,000 of assessed valueJul 01, 2020 · The clark county wa sales tax rate 2018 latest sales tax rate for Camas, WA. This rate includes any state, county, city, and local sales taxes. 2019 rates included for use while preparing your income tax deduction.

Sales tax calculator for Vancouver, Washington, United ...

Depending on the zipcode, the sales tax rate of Vancouver may vary from 6.5% to 8.4% Every 2020 combined rates mentioned above are the results of Washington state rate (6.5%), the Vancouver tax rate (0% to 1.9%), and in some case, special rate (0% to 1.9%). There is no county sale tax for Vancouver, Washington.RECENT POSTS:

- genuine leather mini backpacks

- louis vuitton x kanye west don reddit

- st louis zoo camp kangazoo

- car sale on olx punjab

- louis vuitton favorite pm bag

- king louis xiv ballet

- louis vuitton copy bags

- louis vuitton card holder keychain cheap

- louis vuitton one shoulder backpack

- louis vuitton multiple wallet cobalt

- louis vuitton damier keepall 45

- good morning christmas love images

- clearance hobo brand bags

- cost of louis vuitton luggage

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

used cars for sale in karachi olx

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the lv bag monogram empreinte for more info.