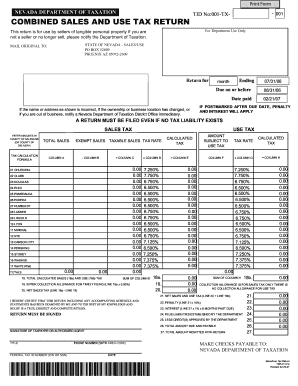

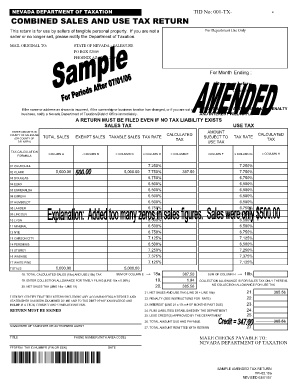

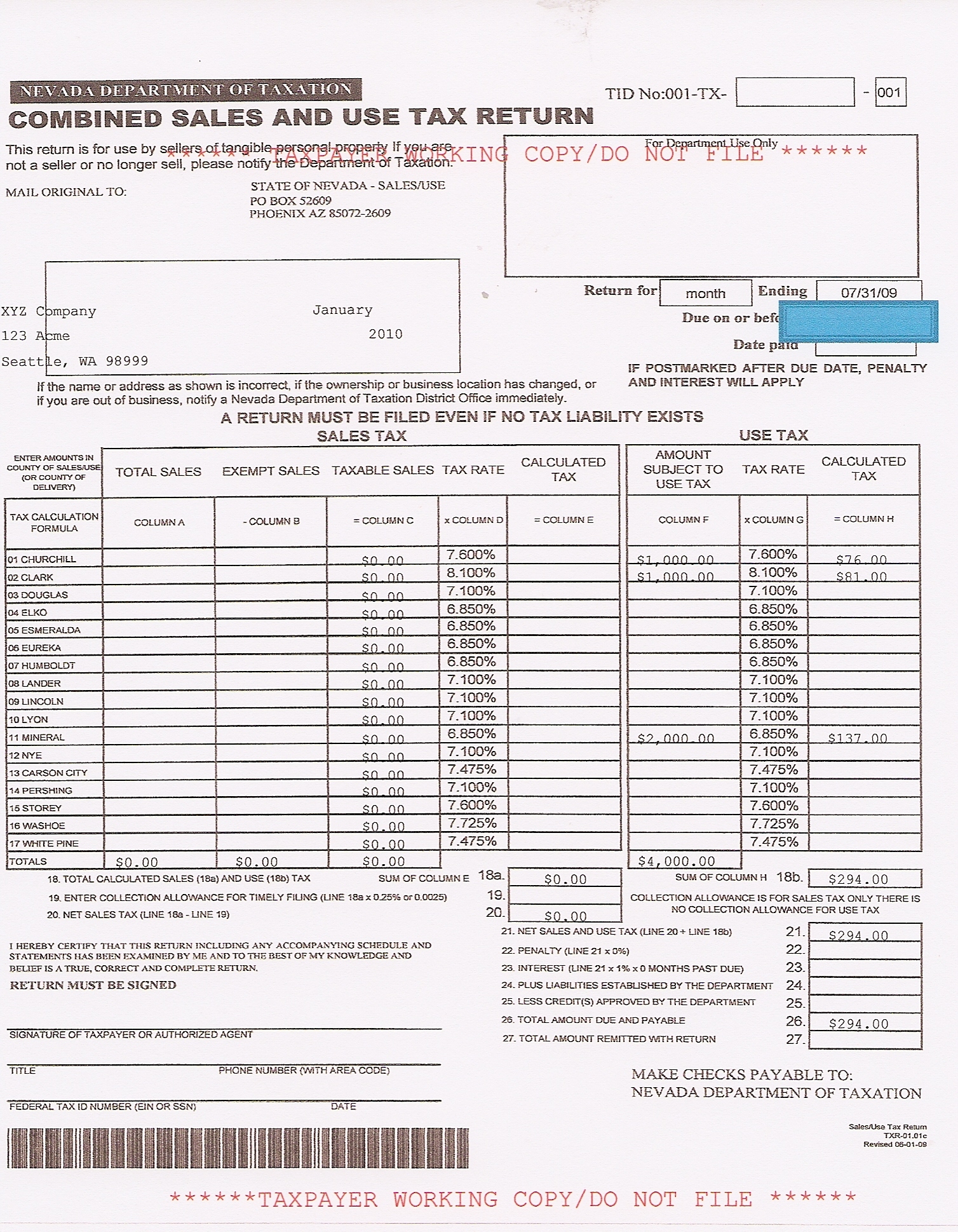

Consumer Sales Tax Form Nevada

File Sales and Use Tax return Online - Nevada Tax - YouTube

How to submit a Sales and Use consumer sales tax form nevada Tax return on Nevada Tax. How to submit a Sales and Use Tax return on Nevada Tax.Consumer Use Tax | Filing Information | Department of ...

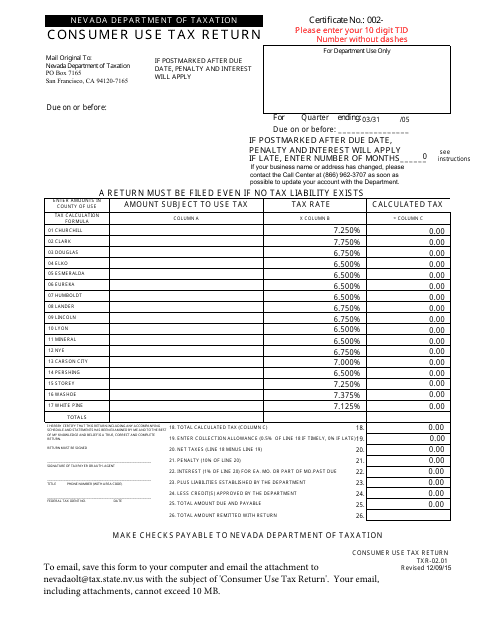

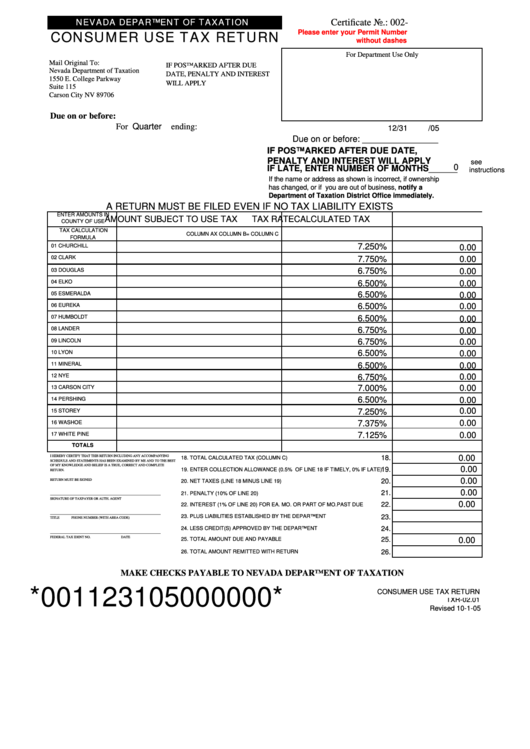

If you are filing an amended return, use the Consumer Use Tax Return Form (DR 0252). Be sure to check the box indicating that this is an amended return (box is located directly above line 1 on the form). Visit the Sales & Use Tax Forms web page to print out a copy of the DR 0252.Understanding Sales Tax Rules for the Construction Industry

However, when you finish the construction project, you're going to have to cut the state a check for sales or use tax on the basis of gross sales for the new construction. Subcontractors May Have Sales Tax Liabilities. Depending on how big a job is, you may be working as either a …Credit for Sales or Use Tax Paid in Another State; Forms and Other Publications; Sales and Use Tax; File consumer sales tax form nevada and Pay. The consumer use tax can be filed and paid on the Tennessee Taxpayer Access Point (TNTAP). A TNTAP logon is NOT required to file this tax. ...

View and Download FREE Consumer Use Tax Return, related FREE Legal Forms, instructions, videos, and FREE Legal Forms information.

Jul 17, 2017 · Last updated July 17, 2017 For more information about collecting and remitting sales tax in Nevada, check out Nevada Sales Tax Resources. 1. Who needs a sales tax permit in Nevada? From the Nevada Department of Taxation website: Every person, firm,

Nevada Sales Tax Rate - 2020

Nevada Sales Tax Exemption Certificate Unlike a Value Added Tax (VAT), the Nevada sales tax only applies to end consumers of the product. Individuals and companies who are purchasing goods for resale, improvement, or as raw materials can use a Nevada Sales Tax Exemption Form to buy these goods tax-free.. Companies or individuals who wish to make a qualifying purchase tax-free must have …Jun 29, 2020 · Sales Tax and Gross Receipts Tax are two different methods of paying taxes on products. Sales tax is paid for by the consumer, while the gross receipts tax is paid for by the business. Depending on your type of business, you may need to pay a form of gross receipts tax. Example: Your LLC does business in a state with 5% sales tax and a state ...

NRS: CHAPTER 372 - SALES AND USE TAXES - Nevada Legislature

No credit or refund of any amount paid pursuant to sections 34 to 38, inclusive, of the Sales and Use Tax consumer sales tax form nevada Act (chapter 397, Statutes of Nevada 1955) and NRS 372.210 to 372.255, inclusive, may be allowed on the ground that the storage, use or other consumption of the property is exempt under section 67 of the Sales and Use Tax Act, unless the ...RECENT POSTS:

- louis vuitton paris men's fashion weekend

- authentic louis vuitton monogram canvas

- virgil abloh shoes louis vuitton

- gucci vintage canvas camera bag

- louis vuitton alma bb epi pink

- louis vuitton tote bags

- ebay louis vuitton crossbody

- louis vuitton purses damier azur

- black friday ads for jcpenney

- best place to buy louis vuitton bag

- louis vuitton christmas shopping bag

- louis vuitton clutch purse with chainsaw

- louis vuitton fragrance mens

- louis vuitton neverfull black handle

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

ebay uk furniture outlet stores

did louis vuitton and gucci bags to snooki

lv speedy bandouliere 30 vs 35mm

is there a louis vuitton store in atlanta

best american made leather bags

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the how to sell louis vuitton neverfull for more info.