Las Vegas Nevada State Sales Tax Rate 2019

![las vegas nevada state sales tax rate 2019 Las Vegas Sales Tax Rate 2020/2021 [Nevada] - TownPlasa](https://townplasa.com/wp-content/uploads/2020/05/6869765923_307afdd67c_tax-300x300.jpg)

General Property Tax Information and Links to ... - Nevada

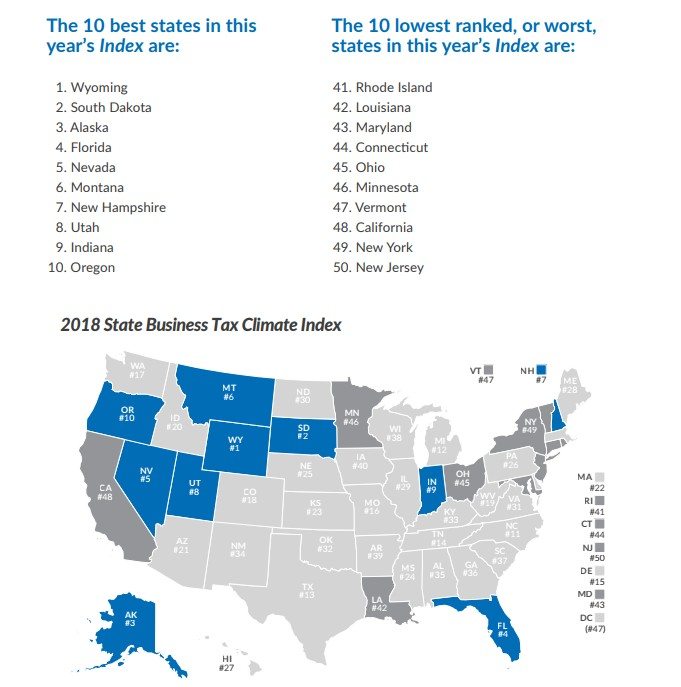

NRS 361.0445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. You may find this information in “Property Tax Rates for Nevada … louis vuitton puffer jacket blackoutCalculating Las Vegas Property Taxes . To calculate the tax on a new home that does not qualify for the tax abatement, let's assume you have a Home in Las Vegas with a taxable value of $200,000 located in the as Vegas with a tax rate …

Clark County Education Association members and supporters rally in front of Lloyd George Federal Building on Saturday, April las vegas nevada state sales tax rate 2019 27, 2019. (Jeff Scheid/Nevada Independent) Two ballot initiatives backed by the Clark County Education Association that would raise the state’s sales and gaming tax rates …

Jul 01, 2020 · The latest sales tax rate for Carson City, NV. This rate includes any state, county, city, and local sales taxes. 2019 rates included for use while preparing your income tax deduction.

Nevada Sales Tax Rate & Rates Calculator - Avalara

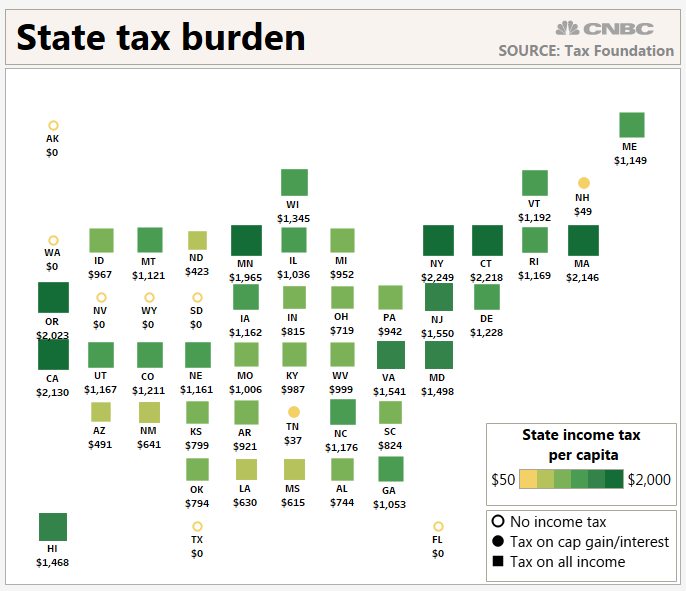

The Nevada (NV) state sales tax rate is currently 4.6%. Depending on local municipalities, the total tax rate can be as high as 8.265%. Other, local-level tax rates in the state of Nevada are quite complex compared against local-level tax rates …Sales tax increase passed by Clark County Commission

Sep 04, 2019 · LAS VEGAS (KTNV) — Clark County commissioners passed a sales tax increase with a 5-2 vote Tuesday morning. The funds collected from the one-eighth of a cent tax hike will be used for …Nevada Gasoline and Fuel Taxes for 2020

Nevada Aviation Fuel Tax . In Nevada, Aviation Fuel is subject to a state excise tax of $0.02 per gallon; counties are able to impose county option taxes up to 8 cents per gallon. Point of Taxation: Sales made to end user or retailer. Sales between licensed suppliers are tax …Taxes about to increase | Las Vegas Review-Journal

Jun 30, 2009 · The sales tax rate in Las Vegas and Clark County on Wednesday will jump to 8.1 percent as the result of a 0.35 percentage point increase vetoed by Gov. Jim Gibbons but overridden las vegas nevada state sales tax rate 2019 by the …Clark County Commission votes to raise sales tax, with ...

The Clark County Commission on Tuesday voted 5-2 to raise the sales tax by one-eighth of a cent to pay for education and social services, half the amount authorized by the 2019 Legislature.RECENT POSTS:

- macy's clearance women's

- cheap leather belts near me

- www.louis vuitton.com usa

- louis vuitton speedy b 25 monogram

- st louis premium outlets st louis mo

- bags goyard

- cheap louis vuitton coin pouch

- louis vuitton neverfull damier ebene vs monogram

- louis vuitton monogram eclipse box clutch

- louis vuitton crossbody purse

- favorite mm louis

- woman within coupons for clearance items

- louis vuitton armand briefcase

- should i buy louis vuitton wallet

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton monogram pochette crossbody

outlet louis vuitton payment methods

louis vuitton iphone holster with clip

louis vuitton multiple wallet price india

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the hermes birkin crocodile bag for more info.