Nevada Motorcycle Sales Tax

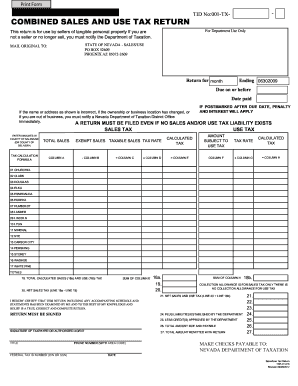

“The sales price of any item sold through this machine includes applicable Nevada State and Local Sales Taxes.” [Tax Comm’n, Combined Sales and Use Tax Ruling part No. 25, eff. 6-14-68] NAC 372.530 Producers of X-ray film for diagnostic use.

Calculating Sales Tax Summary: Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. Find your state below to determine the total cost of your new car, including the ...

FAQ - Nevada Tax Center

a service of the Nevada Department of Taxation. Home; How-To Videos; FAQ; About; Contact Us; Log In; Sign Up; FAQNevada State Taxes: Everything You Need to Know ...

Aug 19, 2018 · Nevada State Personal Income Tax. Nevada is one of the seven states with no income tax, so the income tax rates, regardless of how much you make, are 0 percent.But the state makes up for this with a higher-than-average sales tax. Nevada has the 13th highest combined average state and local sales tax rate in the U.S., according to the Tax Foundation.Note: While this deduction will mainly benefit taxpayers without a state income tax as in: Alaska, Florida, Tennessee, nevada motorcycle sales tax New Hampshire, Nevada, South Dakota, Texas, Washington and Wyoming – it also gives a larger deduction to any taxpayer who paid more in sales tax than income tax. It can also impact any return if the Taxpayer had a large ...

How to Calculate Nevada Sales Tax on a New Automobile | It ...

Nevada offers a tax credit when you trade in a vehicle. Multiply the trade-in allowance (the amount you are getting for the trade) by the appropriate sales-tax rate. If you are receiving $5000 for your trade-in vehicle, and your sales-tax rate is 7.5 percent, you would multiply 5000 by .075.Many countries and jurisdictions around the world apply some sort of tax on consumer purchases, including items bought on eBay. Whether the tax is included in the listing price, added at checkout, charged at the border, or paid directly by the buyer depends on the seller's status, the order price, the item's location, and your shipping address.

Nevada DMV Forms & Publications

Certificate of Inspection/Affidavit of Construction - Motorcycles (VP 064M) To certify the safety of rebuilt, reconstructed or assembled motorcycles. Use the VP 254 for conversions. Motorcycle Highway Use Affidavit (VP 254) nevada motorcycle sales tax To certify the safety of an off-road motorcycle …Nevada Passes Partial Tax Abatement on Aircraft Sales and ...

Nevada's Gov. Brian Sandoval signing a bill on June 8, 2015, which would abate certain tax liabilities for those who own, operate, manufacture and service general aviation aircraft in the state.RECENT POSTS:

- louis vuitton epi wallet mens

- womens designer tote bags sale

- poshmark lv wallet

- louis vuitton small bag cost

- lv virgil abloh belts

- is it cheaper to buy louis vuitton in hawaii

- louis vuitton tote bag australia

- black fanny pack roblox

- louis vuitton small black purses

- louis vuitton leather bucket bag

- who was louis vuitton

- levi outlet gilroy ca

- louis philippe belts amazon

- louis vuitton vavin mm

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton laureate boot youtube

louis vuitton bags for sale philippines

does louis vuitton have black friday sales

leather crossbody bag with long strap for women

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the gucci belt saks fifth for more info.