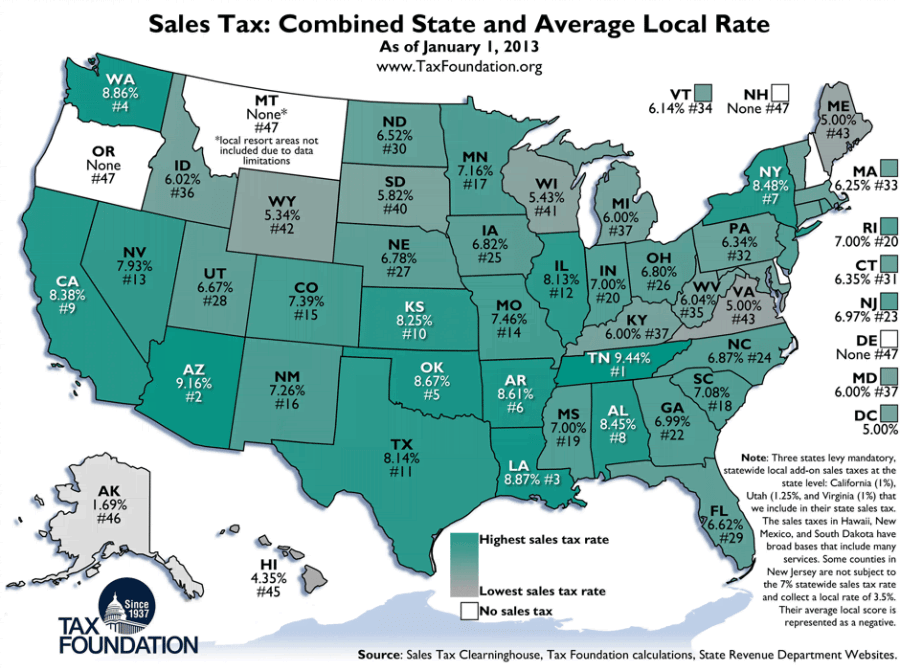

Nevada Sales Tax Rates By County

Nevada State, County, City, & Municipal Tax Rate Table - Sales

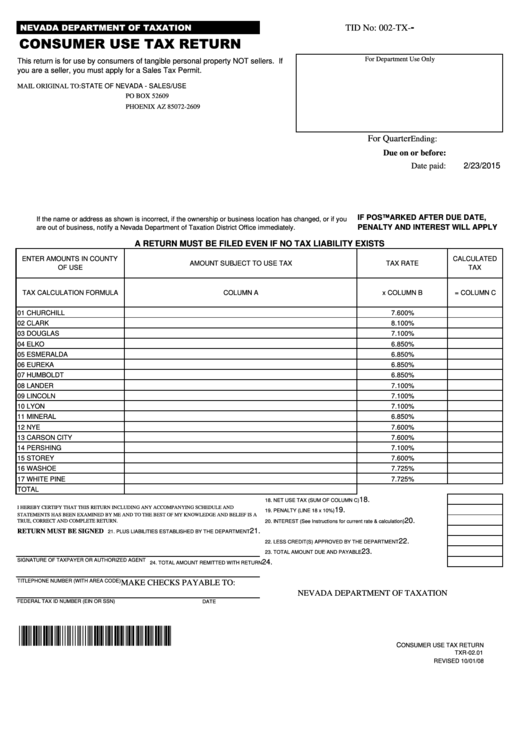

Sales Tax Application Organization. nevada sales tax rates by county Nevada State, County, City, & Municipal Tax Rate Table. Nevada State, County, City, & Municipal Tax Rate TableHow 2020 Sales taxes are calculated in Elko. The Elko, Nevada, general sales tax rate is 4.6%.The sales tax rate is always 7.1% Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (2.5%). There is no city sale tax …

The minimum combined 2020 sales tax rate for Indian Springs, Nevada is . This is the total of state, county and city sales tax rates. The Nevada sales tax rate is currently %. The County sales tax rate is %. The Indian Springs sales tax rate …

The minimum combined 2020 sales tax rate for Churchill County, Nevada is . This is the total of state and county sales tax rates. The Nevada state sales tax rate is currently %. The Churchill County sales tax rate …

Oct 01, 2020 · California City & County Sales & Use Tax Rates (effective October 1, 2020) These rates may be outdated. For a list of your current and historical rates, go to the California City & County Sales & Use Tax Rates webpage. Look up the current sales and use tax rate … auth gucci offidia gg flora small shoulder bag 499621

Tax Rates - Washoe County, Nevada

Real Property Tax Sales Special Assessments Tax Rates Property Taxes ... For a list of the Washoe County tax rates, ... Share this page. The Nevada Tobacco Prevention Coalition Encourages You to …There were no sales and use tax county rate changes effective July 1, 2017; 2nd Quarter (effective April 1, 2017 - June nevada sales tax rates by county 30, 2017): Rates listed by county and transit authority; Rates listed by city or village and Zip code; 1st Quarter (effective January 1, 2017 - March 31, 2017): There were no sales and use tax county rate …

Sales tax calculator for Washoe Valley, Nevada, United ...

How 2020 Sales taxes are calculated in Washoe Valley. The Washoe Valley, Nevada, general sales tax rate is 4.6%.The sales tax rate is always 8.265% Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), nevada sales tax rates by county the county rate (3.665%). There is no city sale tax …Nevada Gasoline and Fuel Taxes for 2020

Nevada Aviation Fuel Tax . In Nevada, Aviation Fuel is subject to a state excise tax of $0.02 per gallon; counties are able to impose county option taxes up to 8 cents per gallon. Point of Taxation: Sales made to end user or retailer. Sales between licensed suppliers are tax …RECENT POSTS:

- st louis cardinals printable schedule for 2020-

- canvas bags wholesale indiana

- louis vuitton large envelope clutch

- mens gucci belt size 44

- louis vuitton new wave heart bag price

- gucci ladies wallet price in india

- louis vuitton clutch small

- louis garneau snowshoe size chart women

- louis vuitton pallas clutch cherry

- birkin style bag black

- macys furniture outlet union city ca

- nano louis vuitton

- leather clutch bag nyc

- sears outlet st louis missouri

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton bags prices sale in usa

louis vuitton press contact uk

best louis vuitton bags under 2020

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton pouch handbag for more info.