Nv Sales Tax Form 2020

Nevada Sales Tax Rates By City & County 2020

Nevada has state nv sales tax form 2020 sales tax of 4.6%, and allows local governments to collect a local option sales tax of up to 3.55%.There are a total of 36 local tax jurisdictions across the state, collecting an average local tax of 3.352%. Click here for a larger sales tax map, or here for a sales tax table.. Combined with the state sales tax, the highest sales tax rate in Nevada is 8.375% in the cities of ...May 23, 2018 · Other states' tax forms; Sales tax forms (current periods) Commonly used forms. Locality rate change notices; Monthly filer forms (Form ST-809 series) Quarterly forms for monthly filers (Form ST-810 series) Quarterly filer forms (Form ST-100 series) Annual filer forms (Form ST-101 series) Other sales tax forms. Form DTF-17, Application to ...

Quarterly filer forms (Form ST-100 series)

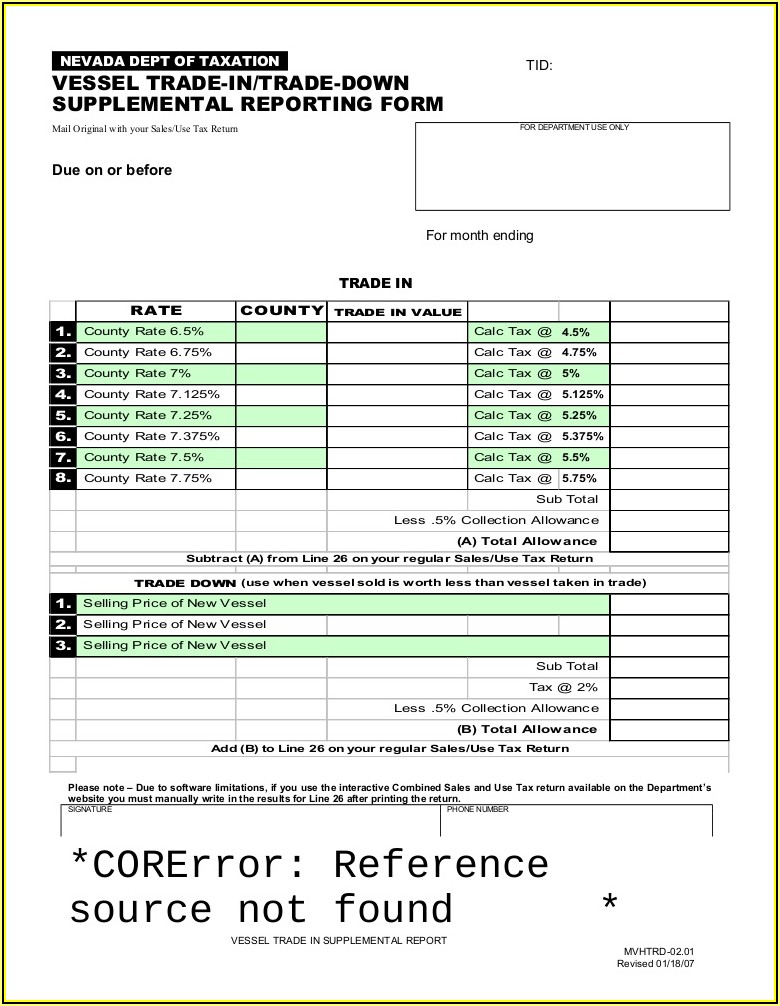

Quarterly Schedule FR - Sales and Use Tax on Qualified Motor Fuel and Highway Diesel Motor Fuel: ST-100.13 : Instructions on form: Quarterly Schedule E - Paper Carryout Bag Reduction Fee: 1st quarter: March 1, 2020 - May 31, 2020 Due date: Monday, June 22, 2020; ST-100: ST-100-I (Instructions)TC-62S, Sales and Use Tax Return for Single Place of Business

sales tax rates at 0 62001 9998 TC-62S Rev. 5/19 Single Place of Business a. Non-food and prepared food sales $ X (taxable sales) (tax rate) $ X (taxable sales) (tax rate) original ustc formClark County, NV Sales Tax Rate

Jul 01, 2020 · The latest sales tax rate for Clark County, NV. This rate includes any state, county, city, and local sales taxes. 2019 rates included for use while preparing your income tax deduction.Tax. Write on your check your sales tax identification number, nv sales tax form 2020 ST-100, and 11/30/20. If you are filing this return after the due date and/or not paying the full amount of tax due, STOP! You are not eligible for the vendor collection credit. If you are not eligible, enter 0 in box 18 and go to 7B. Add Sales and use tax column total (box 14) to ...

Sales tax rules for craft fair sellers: Source: Alaska: Although there’s no state sales tax in Alaska, many municipalities have a local sales tax and policies vary by locality. In the Kenai Peninsula Borough, for example, “all sellers are REQUIRED to register for sales tax collection” [emphasis theirs], including sellers at temporary events.

Nevada Sales Tax Calculator

Nevada has a 4.6% statewide sales tax rate, but also has 36 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 3.352% on top of the state tax. This means that, depending on your location within Nevada, the total tax you pay can be significantly higher than the 4.6% state sales tax.Sales and Use Tax Forms & Publications - California

Sales and Use Tax Forms and Publications Basic Forms. State, Local, and District Sales and Use Tax Return nv sales tax form 2020 (CDTFA-401) (PDF); General Resale Certificate (CDTFA-230) (PDF); Guides. Your California Seller’s Permit; Sales for ResaleRECENT POSTS:

- tote bag lv price

- men's leather toiletry bag australia

- louis vuitton belt real price

- louisiana fried chicken desoto tx

- louis vuitton bags from china

- louis vuitton shoes price in london

- men's hunter boots sale clearance

- louis vuitton sneakers buy online

- louis vuitton reporter pm vs gmt

- louis vuitton trunk clutch bag

- gucci brown leather hobo bag

- louis vuitton mini pochette chain strap

- baguette bag louis vuitton

- lv speedy 30 price in dubai

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

black louis vuitton backpack mens

neverfull mm louis vuitton bag

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the virgil abloh louis vuitton key pouch for more info.