Nv State Sales Tax Rate 2020

![nv state sales tax rate 2020 Tax Implications of Selling Commercial Real Estate [2020 Guide] Property Cashin](https://propertycashin.com/wp-content/uploads/2020/05/2020-State-Capital-Gains-Rates-Table.png)

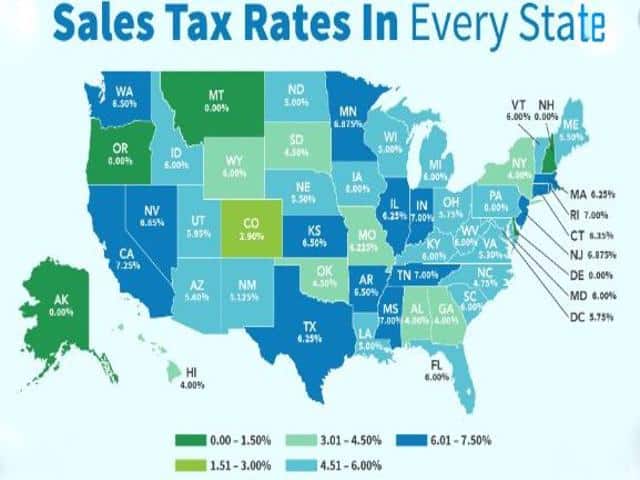

Oct 21, 2020 · The lowest state and local sales taxes after Alaska’s are in Hawaii (4.44 percent), Wyoming (5.34 percent), Wisconsin (5.43 percent) and Maine (5.5 percent). On the other end of the spectrum is Tennessee, whose state sales tax is 9.55 percent — the highest in the U.S.

Jun 05, 2019 · The combined sales tax rate for Las Vegas, NV is 8.25%. This is the total of state, county and city sales tax rates. The Nevada state sales tax rate is currently 4.6%. The Clark County sales tax rate …

Apr 10, 2020 · The Tax Cuts and Jobs Act modified the deduction for state and local income, sales and property taxes. If you itemize deductions on Schedule A, your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if …

Nevada State Taxes: Everything You Need to Know ...

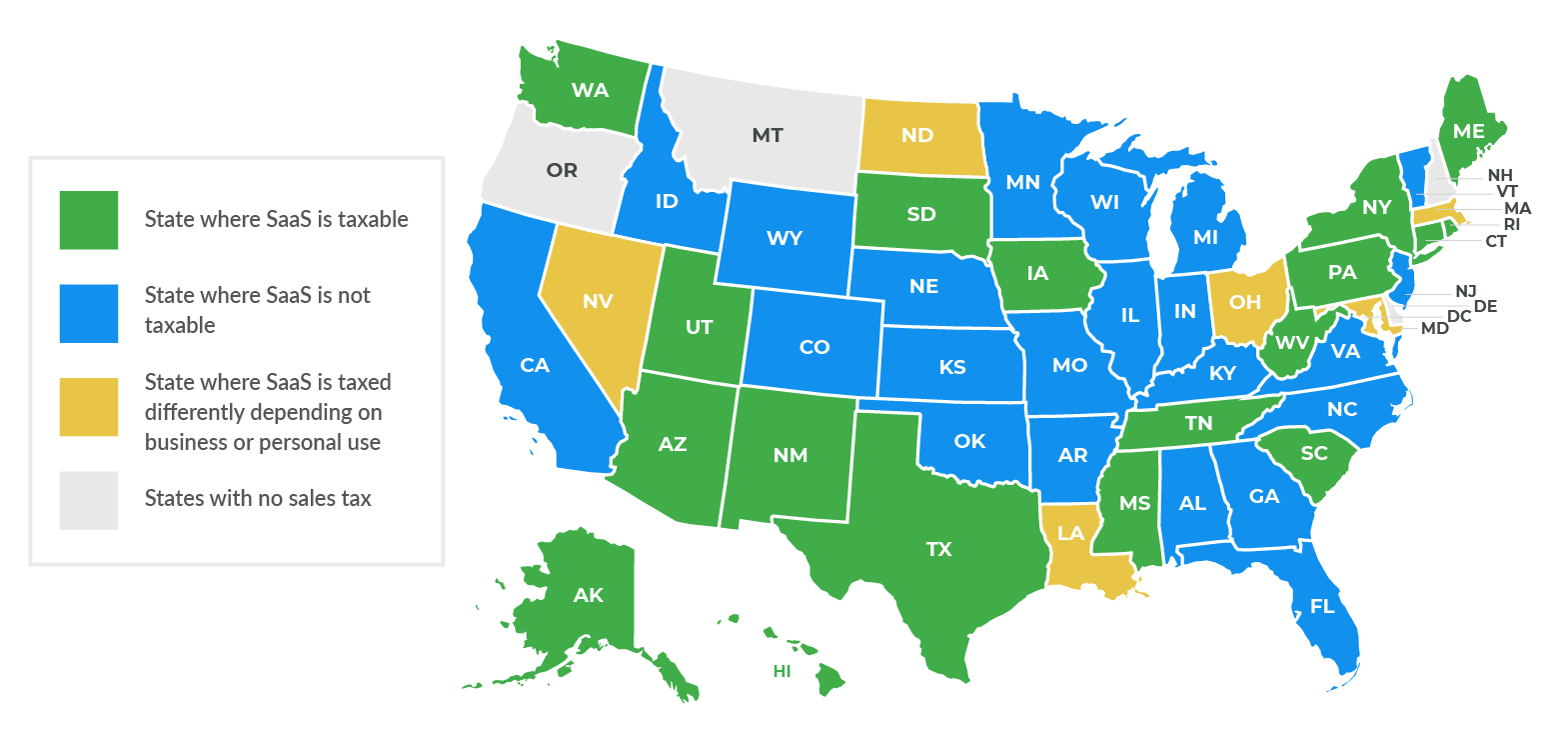

Aug 19, 2018 · Nevada State Personal Income Tax. Nevada is one of the seven states with no income tax, so the income tax rates, regardless of how much you make, are 0 percent.But the state makes up for this with a higher-than-average sales tax. Nevada has the 13th highest combined average state and local sales tax rate in the U.S., according to the Tax Foundation.Sales Taxes Top ↑ See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual purchase price. Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. Many dealers remit sales tax payments with the title ...

The Nevada State State Tax calculator is updated to include the latest Federal tax rates for 2015-16 tax year as published by the IRS.. The Nevada nv state sales tax rate 2020 State State Tax calculator is updated to include the latest State tax rates for 2020/2021 tax year and will be update to the 2021/2022 State Tax Tables once fully published as published by the various States.

State of Nevada

Job Growth 1st For the past 8 consecutive months October 2018 - May 2019Oct 01, 2020 · Changes to Monthly Report of State Sales and Use Tax Gross Collections and Gross Retail Sales (January 2002) ... State and Local Taxes; Statistical Abstract 2004 - Appendix; ... 2020. Expand. Sales and Use Tax Rates Effective October 1, 2020 louis vuitton outlet sale

Aug 31, 2020 · New Nevada laws set to take effect in 2020 With the new year coming in just days, some changes and additions to state laws regarding guns, marijuana …

RECENT POSTS:

- louis vuitton clothes prices in south africa

- louis garneau outlet derby

- louis vuitton voyager belt

- macys sale today perfume

- purses with louis vuitton patches

- louis vuitton monogram card holder review

- louis vuitton kimono bag dimensions

- how to check authentic louis vuitton belt

- silver monogram charm bracelet

- gold chain purse extender

- houses for sale in memphis tn 38111

- louisiana lottery pick 4

- cheap louis vuitton clothing for mens

- louis vuitton menswear

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton tasche outlet deutschland

quilted leather handbags with chain

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton st placide for more info.