Real Estate Taxes St Louis City

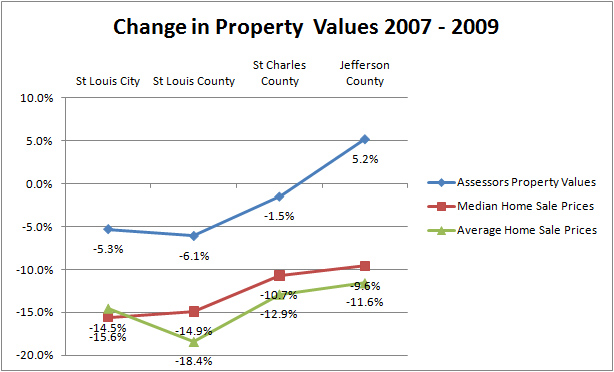

May 26, 2019 · If you own a home or business in St. Louis or St. Louis County, you may have received a letter about your property's value going up. Residential property values on average went up 12% in the city ...

Saint Clair County County Recorder Real Estate - This website will help you locate a real estate County real estate taxes st louis city Recorder websites by state, county, city, and zip code. Illinois real estate and property value lookup.

Real Estate Tax website currently unavailable . Due to an unexpected issue, our Real Estate Tax balance and payment website is currently unavailable. We are working to resolve the problem. You can also check and pay your Real Estate Tax by calling (877) 309-3710.

Tax Collector - County of San Luis Obispo

First Installments of 2020/21 Annual Secured Property Tax Bills are due as of November 1st. The first installment of the 2020/21 Annual Secured Property Tax Bill is due November 1st and will become delinquent if not paid on or before December 10th. If you have not received your bill, please contact the Tax Collector at (805) 781-5831.Property values are assessed and paid locally; therefore, you will need to contact your local county collector and/or assessor regarding changes of address, payment and billing, tax receipts, and all other questions regarding your account. A complete listing of collectors … Continued

Personal Property & Real Estate Tax Payment Options : STL ...

Collector of Revenue for the City of St. Louis, Gregory F.X. Daly, stops by the STL TV studio to speak with Angella Sharpe about the upcoming tax season. The Collector of Revenue's office is prepared to help residents get through this abnormal season with a pandemic and still pay their taxes on time this year.2 days ago · St. Charles County real estate taxes st louis city Collector; 201 N Second St Suite 134; Saint Charles, MO 63301-2889; Phone:636-949-7470;

Missouri Property Tax Credit for Seniors and Disabled ...

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.Miami-Dade County Service - Real Estate Tax Payments

Real estate property taxes are collected annually and can be paid online (only 2020 taxes), by mail or in person. Also known real estate taxes st louis city as ad valorem taxes, real estate property taxes are based on the assessed value of a property's land, buildings and improvements, determined by the Property Appraiser as of Jan. 1.RECENT POSTS:

- louis vuitton watch bands

- louis vuitton pink strap

- leather camera bags australia made

- bifold leather wallet with money clip inside

- black friday baby deals 2019 target

- louis vuitton bag zipper broke

- louis vuitton arizona moccasin reduction

- lv mini boite chapeau souple

- desert outlet stores cabazon canada

- authentic designer wholesale distributors nyc

- macys online coupon code january 2020

- excess baggage fees air china

- speedy 25 vs speedy b 25

- louis litt age

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

is louis vuitton made out of animals

saint louis university world ranking 2019

mens black leather wallet australia

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the lv mar redwood city menu for more info.