Sales Tax Carson City Nv 2016

Property Taxes | Carson City

Should a property have continuing delinquent outstanding taxes at the end of three years the Treasurer will take a trustee deed to the property and begin the process to sell the property at a tax sale. Each year several properties begin this sale process but in actuality, Carson City … league of legends lv skinsBallot questions -- STATE 4. No sales tax on ... - Carson Now

Nov 02, 2016 · Submitted by Carson sales tax carson city nv 2016 Now Reader on Wed, 11/02/2016 - 5:17am ... Which, in a state with a sales tax, means everybody. ... CARSON CITY — Nevada State Treasurer Zach Conine announced …The City’s sole interest is the recovery of all delinquent taxes, penalties, interest, and costs. If I am the successful bidder, how do I pay for the property? Payment in full must be received by the Carson City Treasurer’s office by 3:00 p.m. on the day of the sale.

Fernley, NV Sales Tax Rate

Jul 01, 2020 · The latest sales tax rate for Fernley, NV. This rate includes any state, county, city, and local sales taxes. 2019 rates included for use while preparing your income tax deduction.Carson City, NV Tax Sales & Tax lien Auction Homes ...

Find Tax Sales & Tax Lien Auction Homes in Carson City, NV. View Carson City tax sale house photos, foreclosure tax sale home details, home tax sale outstanding loan balances and tax lien deeds foreclosures on RealtyStore.Carson City County, Nevada Sales Tax Rate

The Carson City County, Nevada sales tax is 7.60%, consisting of 4.60% Nevada state sales tax and 3.00% Carson City County local sales tax carson city nv 2016 sales taxes.The local sales tax consists of a 3.00% county sales tax.. The Carson City County Sales Tax is collected by the merchant on all qualifying sales made within Carson City County; Groceries are exempt from the Carson City County and Nevada state sales taxesNevada Sales Tax Guide for Businesses - TaxJar

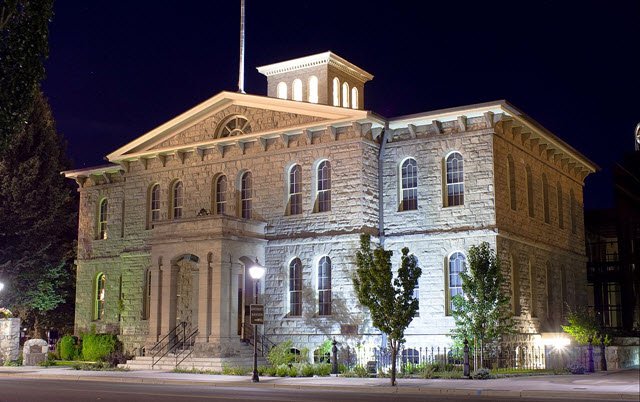

Read here for sales tax carson city nv 2016 more about Amazon FBA and sales tax nexus.Here’s a list of all Amazon Fulfillment Centers in the United States.. Do you have economic nexus in Nevada? Effective October 1, 2018, Nevada considers vendors who make more than $100,000 in sales …NEVADA TAX COMMISSION MEETING MEETING MINUTES Nevada Legislative Building 401 S. Carson Street, Room 2135 Carson City, Nevada Video Conference Legislative Counsel Bureau Grant Sawyer State Office Building 555 E. Washington Ave., Room 4401 Las Vegas, Nevada May 16, 2016 …

Gardnerville, NV Sales Tax Rate

The latest sales tax rate for Gardnerville, NV. This rate includes any state, county, city, and local sales taxes. 2019 rates included for use while preparing your income tax deduction.RECENT POSTS:

- macys coupon printable september 2020

- level thrive promo code august 2019

- louis vuitton round bag 2019-20

- louis vuitton chain purse

- louis vuitton manhattan gm measurements

- bucket louis vuitton bag

- all louis vuitton logos

- designer baby bag louis vuitton

- lv durag and bonnet settlement

- louis vuitton shoulder bags monogram bb

- how to spot a real louis vuitton speedy 300

- louis vuitton repair shop near medina

- small mens zippered wallet

- leather backpacks for men

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

levi's outlet job application form

louis vuitton taurillon leather

damier azur replica credit holder

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton graffiti neverfull pink for more info.