Sales Tax In Nevada County Ca

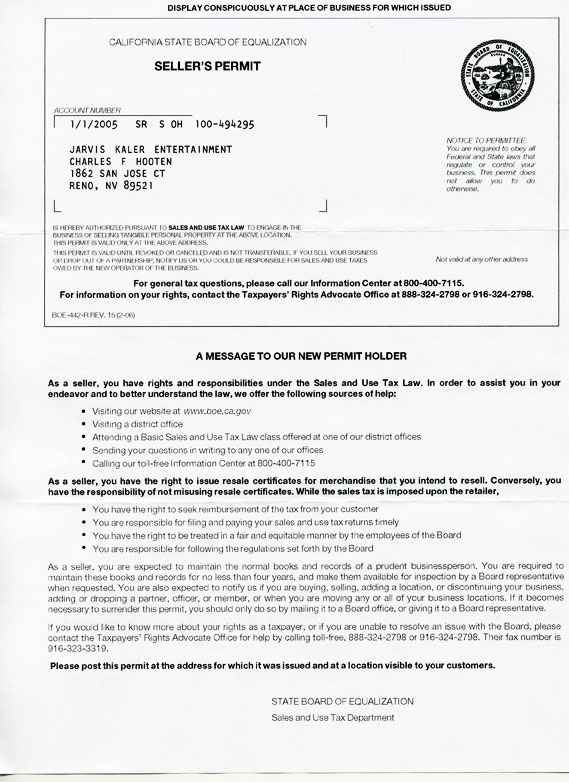

Oct 05, 2020 · Type an address above and click "Search" to sales tax in nevada county ca find the sales and use tax rate for that location. All fields required. ... For more information about tax rates, visit our California City & County Sales & Use Tax Rates webpage. | Looking for the Tax Rate API?

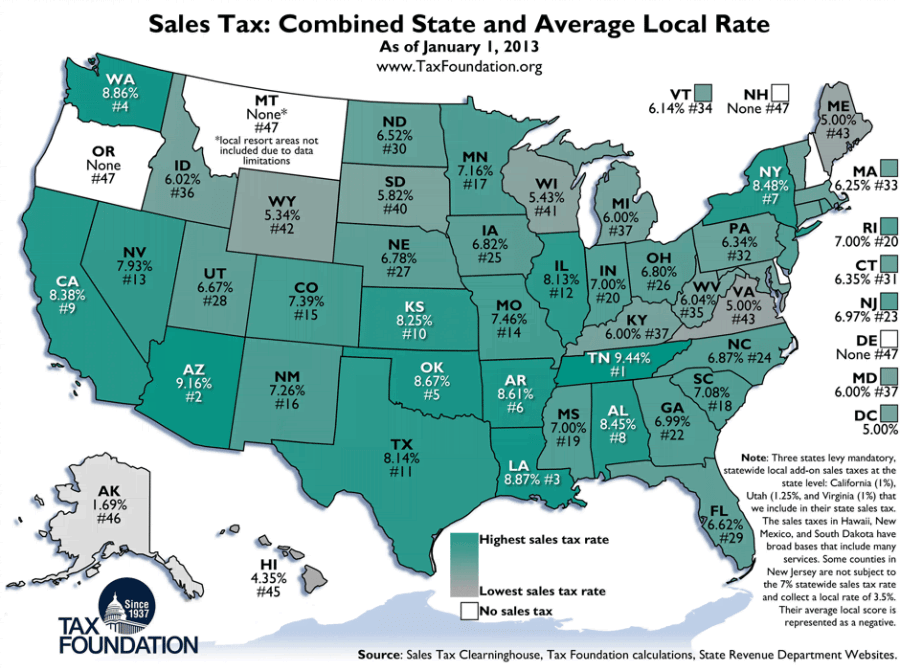

The 7.5% sales tax rate in Nevada City consists of 6% California state sales tax, 0.25% Nevada County sales tax and 1.25% Special tax. There is no applicable city tax. You can print a 7.5% sales tax table here.For tax rates in other cities, see California sales taxes by city and county.

Floriston, California's Sales Tax Rate is 7.5%

The 7.5% sales tax rate in Floriston consists of 6% California state sales tax, 0.25% Nevada County sales tax and 1.25% Special tax. There is no applicable city sales tax in nevada county ca tax. You can print a 7.5% sales tax table here.For tax rates in other cities, see California sales taxes by city and county.Smartsville, California's Sales Tax Rate is 7.5%

The 7.5% sales tax rate in Smartsville consists of 6% California state sales tax, 0.25% Yuba County sales tax and 1.25% Special tax. There is no applicable city tax. The sales tax jurisdiction name is Nevada County, which may refer to a local government division.You can print a 7.5% sales tax table here.For tax rates in other cities, see California sales taxes by city and county.If proof cannot be provided, Use Tax must be paid to Nevada. Sales Tax legitimately paid to another state is applied as a credit towards Nevada Use Tax due. NAC 372.055, NRS 372.185. Do I have to pay Nevada Sales Tax when I purchase a boat? Yes, if the boat is purchased for use or storage in Nevada.

Apr 06, 2017 · Coldwell Banker Grass Roots Realty specialize in Nevada County real estate. Search homes for sale in Grass Valley, Nevada City, Penn Valley, Lake sales tax in nevada county ca Wildwood, Auburn and Lake of the Pines CA. Search land, commercial properties for sale and lease. Browse our experienced Realtors, sales associates, agents.

Jul 01, 2019 · Find a list of the latest sales and use tax rates at the following link: California City & County Sales & Use Tax Rates. You can look up a tax rate by address; Visit or call our Offices; Call our Customer Service Center at 1-800-400-7115 (TTY:711).

Sales tax on cars and vehicles in Nevada

Average DMV fees in Nevada on a new-car purchase add up to $33 1, which includes the title, registration, and plate fees shown above.. Nevada Documentation Fees . Dealerships may also charge a documentation fee or "doc fee", which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. These fees are separate from the taxes and DMV fees ... louis vuitton outletRead here for more about Amazon FBA and sales tax nexus.Here’s a list of all Amazon Fulfillment Centers in the United States.. Do you have economic nexus in Nevada? Effective October 1, 2018, Nevada considers vendors who make more than $100,000 in sales annually in the state or more than 200 transactions in the state in the previous or current calendar year to have economic nexus.

RECENT POSTS:

- belt and road initiative bri

- kate spade small crossbody bags

- wallet clutch purse red leather

- aaa missouri st. louis mo 63108

- women's slim card holder wallet

- bean bags for sale cheap in kenya

- louis vuitton luggage knock off

- nordstrom coach purses on sale

- louis vuitton sawgrass outlet

- black and gold handbags

- grocery tote bags bulk

- mcm boston bag cognac color

- samsung 75 inch tv black friday best buy

- black louis vuitton sneaker

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton travel duffle bag

louis vuitton women's bracelet

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton handbags saks fifth avenue for more info.