Sales Tax Nevada Calculator

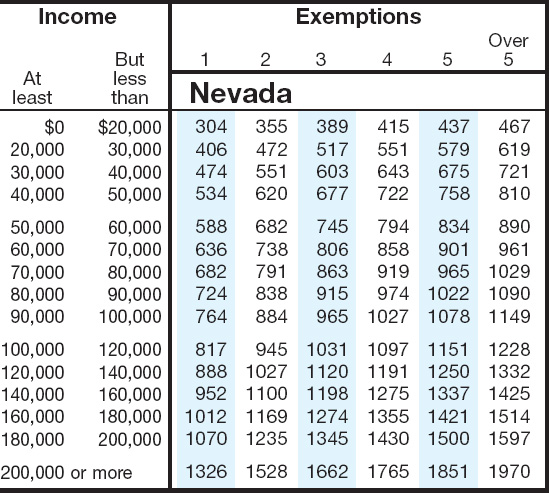

Tax Forms - Nevada

The Department's Common Forms page has centralized all of our most used taxpayer forms for your convenience. The documents found below are available in at least one of three different formats (Microsoft Word, Excel, or Adobe Acrobat [.PDF]).You sales tax nevada calculator are able to use our Nevada State Tax Calculator in to calculate your total tax costs in the tax year 2020/21. Our calculator has recently been updated in order to include both the latest Federal Tax Rates, along with the latest State Tax Rates.

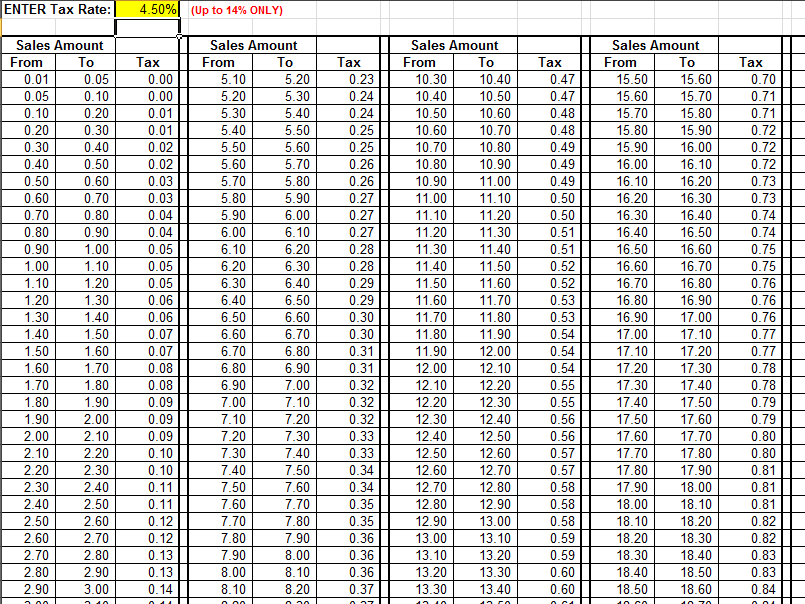

Sales Tax Calculator

Jul sales tax nevada calculator 01, 2020 · Sales Tax Calculator. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due. The sales tax added to the original purchase price produces the total cost of the purchase.Welcome to the Nevada Tax Center

Jan 01, 2020 · Welcome to the Nevada Tax Center The easiest way to manage your business tax filings with the Nevada Department of Taxation. Log In or Sign Up to get started with managing your business and filings online.Our sales tax calculator will calculate the amount of tax due on a transaction. The calculator can also find the amount of tax included in a gross purchase amount.

Higher sales tax than any other Nevada locality -0.225% lower than the maximum sales tax in NV The 8.375% sales tax rate in Las Vegas consists of 4.6% Nevada state sales tax and 3.775% Clark County sales tax .

What transactions are subject to the sales tax in Nevada?

In the state of Nevada, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. Some examples of items that exempt from Nevada sales tax are certain kinds of machinery, groceries, prescription medication, and medical devices.Aug 14, 2020 · Sales tax. The sales tax is the traditional tax we’re all used to paying when we make purchases. The tax rate differs from state to state and city to city, usually it’s between 4 percent and 17 percent. For example, the rate in Oregon is 17% while the sales tax in Montana is 4%.

How Does Reverse Sales Tax Calculator Nevada Work? sales tax nevada calculator Sometimes, you might need to figure out the total amount to pay without the sales tax amount added to it. In that area, you will in need of relying on a “ Reverse Sales Tax Calculator ”, and guess what, we’ve got that too on our page for your convenience.

RECENT POSTS:

- louis vuitton alma gm pomme detroit

- attrape reves louis vuitton price

- louis vuitton shopper bag cena

- neonoe louis vuitton review

- horizon gold outlet login

- louis vuitton afternoon swim buy

- leather supreme backpack

- woodbury common outlet stores nyc

- lv canvas bag

- louis vuitton mini pleaty pink

- off-white mini binder clip leather shoulder bag

- louis vuitton wallet men amazon

- family fun hotels in st louis

- louis vuitton garden state plaza nj

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton bags on sale new york city ny

louis vuitton crossbody bags 2019-20

louis vuitton prada gucci chanel

keepall bandouliere bag monogram canvas 60

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton scarf silk blackout for more info.