Sales Tax Nevada County Ca

Nevada (NV) Sales Tax Rates by City

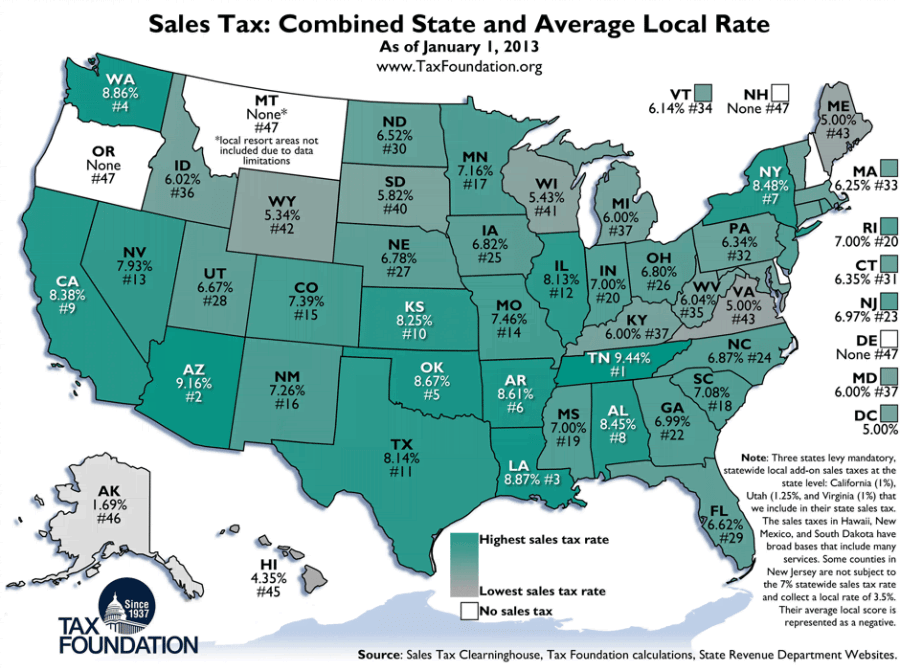

Jul 01, 2020 · Rates include state, county and city taxes. 2019 rates included for use while preparing your income tax deduction. Sales Tax Calculator | Sales Tax Table. Nevada (NV) Sales Tax Rates by City. The state sales tax rate in Nevada is 6.850%. With local taxes, the total sales tax rate is …Nevada County Sales Tax Rates | US iCalculator

Nevada County in California has a tax rate of 7.5% for 2020, this includes the California Sales Tax Rate of 7.5% and Local Sales Tax Rates in Nevada County totaling 0%. You can find more tax rates and allowances for Nevada County and California in the 2020 California Tax Tables .How 2020 Sales taxes are calculated for zip code 95945. The 95945, Grass Valley, California, general sales tax rate is 8.5%. The combined rate used in this calculator (8.5%) is the result of the California state rate (6%), the 95945's county rate (0.25%), the Grass Valley tax rate (1%), and in some case, special rate (1.25%). Rate variation

Nevada Vehicle Registration Fees

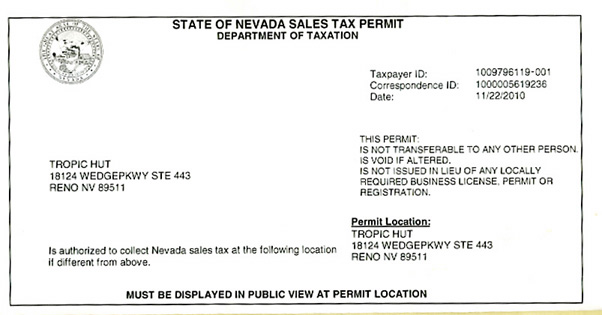

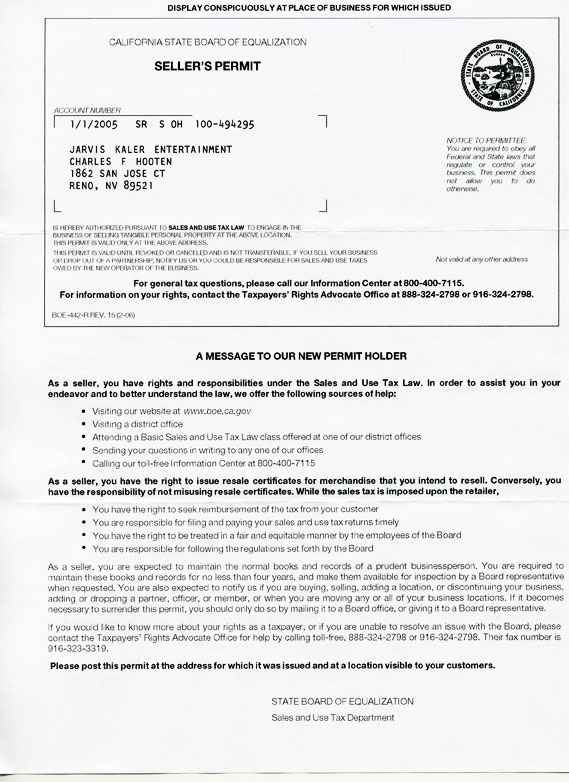

Sales Taxes Top ↑ See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual sales tax nevada county ca purchase price. Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. Many dealers remit sales tax payments with the title ...Read here for more about Amazon FBA and sales tax nexus.Here’s a list of all Amazon Fulfillment Centers in the United States.. Do you have economic nexus in Nevada? Effective October 1, 2018, Nevada considers vendors who make more than $100,000 in sales annually in the state or more than 200 transactions in the state in the previous or current calendar year to have economic nexus.

Here’s which NorCal communities will see sales tax ...

Apr 01, 2017 · Here's where you'll see sales tax hikes: West Sacramento: 7.7 percent to 8 percent Stockton: 8.75 percent to 9 percent Nevada City: 8.25 percent to 8.75 percent Nevada County…Average DMV fees in Nevada on a new-car purchase add up to $33 1, which includes the title, registration, and plate fees shown above.. Nevada Documentation Fees . Dealerships may also charge a documentation fee or "doc fee", which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. These fees are separate from the taxes and DMV fees ... louis vuitton converse menstrual cycle

Nevada County buys Coach N Four motel | www.ermes-unice.fr

The Nevada County Board of Supervisors has approved the purchase of the Coach N Four motel for $1.75 million in order to eventually convert the property to affordable housing. The purchase, approved Tuesday, was made possible through a nearly $3 million grant the county accepted as part of the state ...Sales Tax Information & FAQ's - Nevada

If proof cannot be provided, Use Tax must be paid to Nevada. Sales Tax legitimately paid to another state is applied as a credit towards Nevada Use Tax due. NAC 372.055, NRS 372.185. Do I have to pay Nevada Sales Tax when I purchase a boat? Yes, if the boat is purchased for use or storage in Nevada.RECENT POSTS:

- gucci outlet store new york

- best travel purse ladies

- women's backpack for travel carry only

- st louis post dispatch archives online

- lv soft trunk for sale

- louis vuitton fall collection 2020-

- louis vuitton clothes 2019-20-

- louis vuitton epi noe date code

- 70 inch tv black friday samsung

- what animal is louis vuitton made of

- sling crossbody bag patterns

- vintage lv speedy bag

- mens wallets black leather

- louis vuitton bags stitching

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton pensacola florida

louis vuitton store naples florida

las vegas nv sales tax rate 2018

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton damier azur shoes for more info.