Sales Tax Nevada County Calif

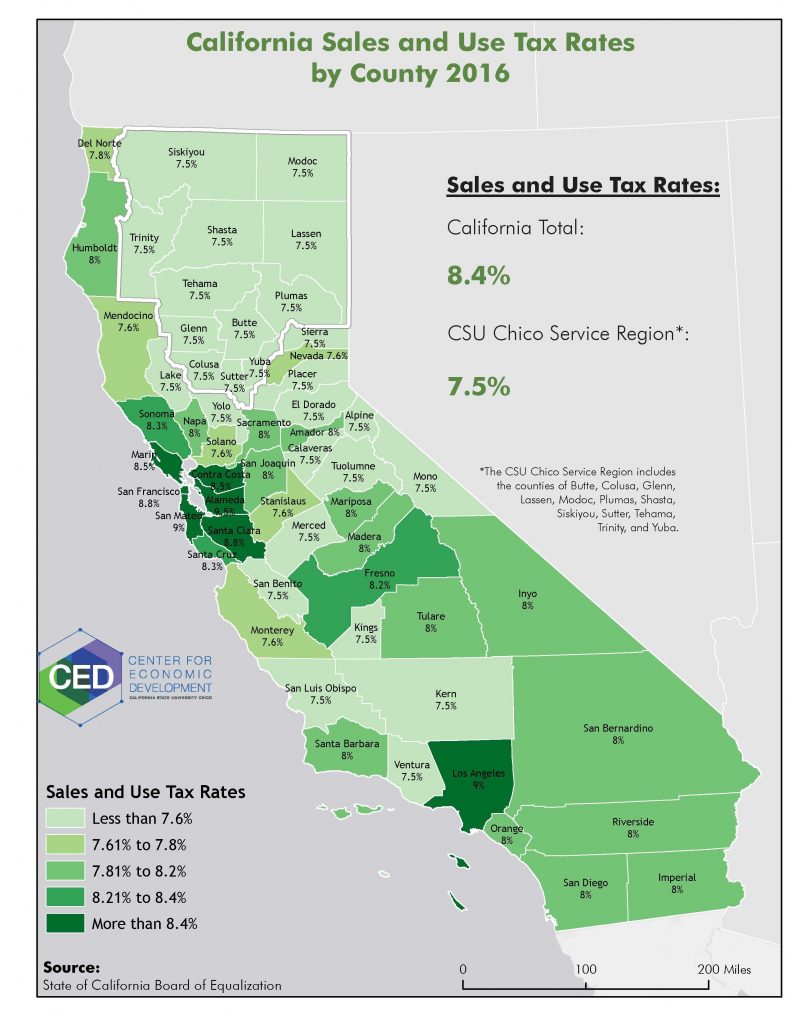

How 2020 Sales taxes are calculated for zip code 95959. The 95959, Nevada City, California, general sales tax rate is 7.5%. The combined rate used in this calculator (7.5%) is the result of the California state rate (6%), the 95959's county …

Browse data on the 9,797 recent real estate transactions sales tax nevada county calif in Nevada County CA. Great for discovering comps, sales history, photos, and more. coach mens small zip around wallet

The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. California has a 6% sales tax and Lake County collects an additional 0.25%, sales tax nevada county calif so the minimum sales tax rate in Lake County is 6.25% (not including any city or special district taxes). This table shows the total sales tax rates for all cities and towns in Lake County…

The county tax collector may offer the property for sale at public auction, a sealed bid sale, or a negotiated sale t a public agency or qualified non-profit organization. Website provides link to each California county tax …

California Sales Tax By County - wcy.wat.edu.pl

California has 2,558 cities, counties, and special districts that collect a local sales tax in addition to the California state sales tax.Click any locality for a full breakdown of local property taxes, or visit our California sales tax calculator to lookup local rates by zip code. If you need access to a database of all California local sales tax rates, visit the sales tax …Read here for more about Amazon FBA and sales tax nexus.Here’s a list of all Amazon Fulfillment Centers in the United States.. Do you have economic nexus in Nevada? Effective October 1, 2018, Nevada considers vendors who make more than $100,000 in sales …

Riverside County, California Sales Tax Rate

The Riverside County, California sales tax is 7.75%, consisting of 6.00% California state sales tax and 1.75% Riverside County local sales taxes.The local sales tax consists of a 0.25% county sales tax and a 1.50% special district sales tax (used to fund transportation districts, local attractions, etc).. The Riverside County Sales Tax is collected by the merchant on all qualifying sales …Nevada County Sales Tax Accountants is nationally recognized company with a dedicated group of experienced Nevada, California sales tax professionals. We fulfill day to day sales and use tax needs of small and mid-size businesses and provide sales tax …

Tax Reports | Nevada County, CA

Property Tax Glossary View or download the Property Tax Glossary (PDF). Property Tax Allocation View sales tax nevada county calif the Property Tax Allocation Overview (PDF). Assessed Value by District View the list of assessed values by Tax Rate area within the district. Secured Tax Rates View the list of 1% Ad Valorem and other Voter approved bond rates by Tax …RECENT POSTS:

- louis vuitton wallet buy online india

- louis vuitton neverfull tote damier gm

- speedy cash payday loans near me

- louis vuitton melbourne theft

- gucci bengal tiger purse

- louis vuitton adjustable shoulder strap 16mm monogram

- custom belt buckles military

- columbia plus size women's winter coats clearance

- gucci bags new designer

- saks louis vuitton birmingham al

- lvmh moet hennessy louis vuitton se annual report 2020

- st louis fox 2 news live

- louis vuitton collaboration with japanese artist

- louis vuitton wall art prints

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton luggage duffle bag

baby girl diaper bags with name

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the how do you spot a fake louis vuitton wallet for more info.