Sales Tax Nevada Rate

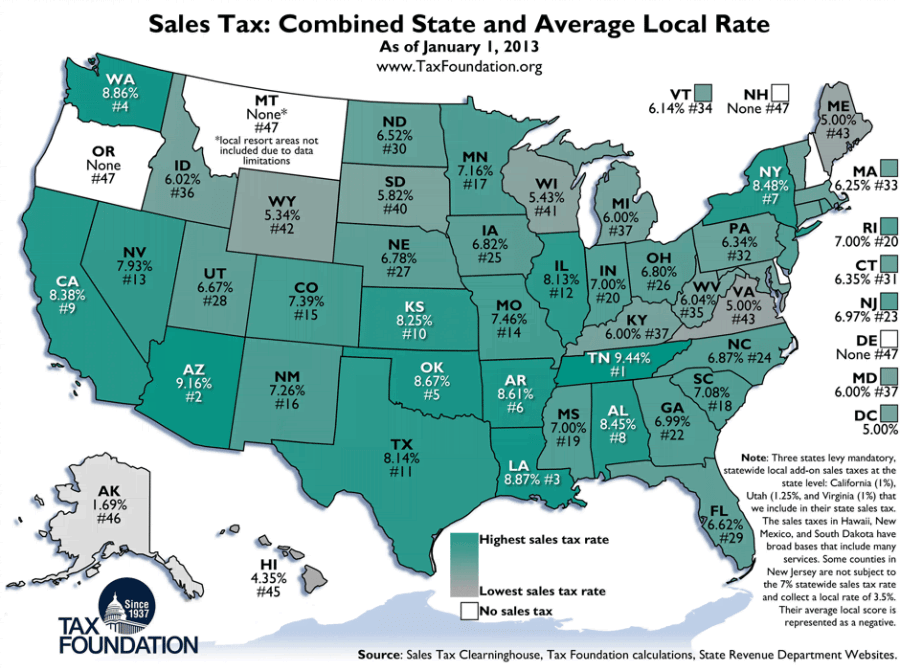

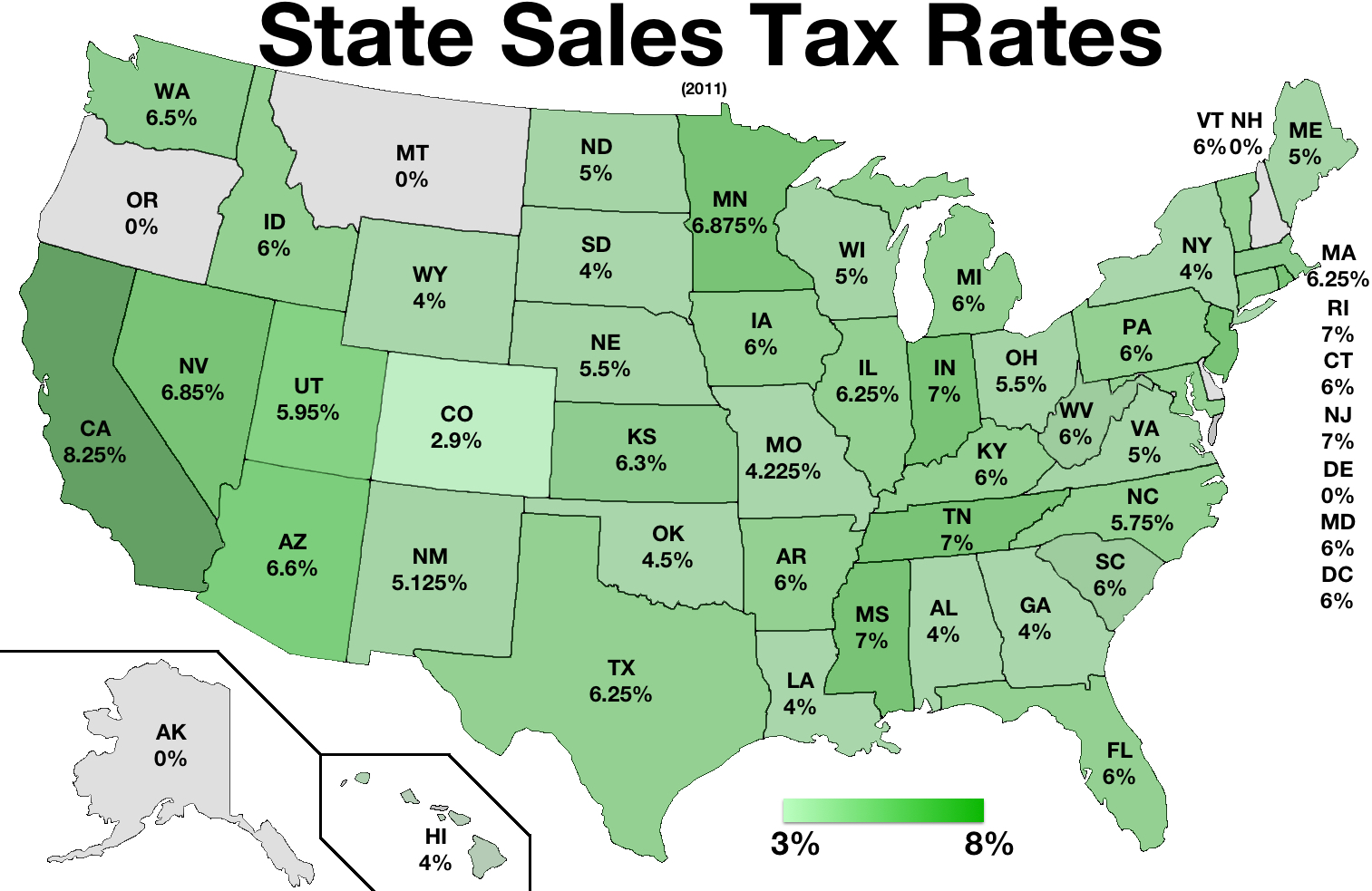

Many states allow local governments to charge a local sales tax in addition to the statewide sales tax, so the actual sales tax rate may vary by locality within each state. Choose any state for more information, including local and municiple sales tax rates is applicable. For state use sales tax nevada rate tax rates, see Use Tax By State. louis vuitton escale keepall

The minimum combined 2020 sales tax rate for Winnemucca, Nevada is . This is the total of state, county and city sales tax rates. The Nevada sales tax rate is currently %. The County sales tax rate is %. The Winnemucca sales tax rate is %. The 2018 United States Supreme Court decision in South Dakota v.

Sales Tax Calculator

Free calculator to find any value given the other two of the following three: before tax price, sales tax rate, and after-tax price. Also, check the sales tax rates in different states of the U.S., understand the forms of sales taxes used in different regions of the world, or explore hundreds of other calculators addressing topics such as finance, math, fitness, health, and many more.A Comparison of State Tax Rates | Nolo

other taxes, such as death and gift taxes, and documentary and stock transfer taxes. The mix of taxes the states utilize to finance their activities can vary markedly from state to state. For example, sales tax nevada rate seven states don't have income taxes: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.How 2020 Sales taxes are calculated for zip code 89103. The 89103, Las Vegas, Nevada, general sales tax rate is 8.375%. The combined rate used in this calculator (8.375%) is the result of the Nevada state rate (4.6%), the 89103's county rate (3.775%). Rate variation The 89103's tax rate may change depending of the type of purchase.

Jan 01, 2020 · The Department is now accepting credit card payments in Nevada Tax (OLT). Click Here for details.; NEW! Click here to schedule sales tax nevada rate an appointment; Clark County Tax Rate Increase - …

The minimum combined 2020 sales tax rate for Indian Springs, Nevada is . This is the total of state, county and city sales tax rates. The Nevada sales tax rate is currently %. The County sales tax rate is %. The Indian Springs sales tax rate is %. The 2018 United States Supreme Court decision in South Dakota v.

The 10 Most Tax-Friendly States in the U.S. | Kiplinger

Oct 31, 2019 · Still, Nevada relies heavily on sales taxes to pay the bills. The average combined state and local sales tax rate is 8.14%, which is tied with Missouri for the 14th-highest in the nation.In some cases, the local sales tax rate can be higher than the state sales tax rate. So when you’re comparing sales tax rates from state to state, look at both the combined state and local sales tax. The five states with the highest average combined state and local sales tax rates are: Tennessee: 9.47%; Louisiana: 9.45%; Arkansas: 9.43% ...

RECENT POSTS:

- harga tas lv seconds

- crossbody clutch bags

- new yorker tote bag never came

- louis vuitton repair price list 2019

- datamax inc st louis mo

- lv neverfull damier azur pink

- louis vuitton wilderness sneaker price

- saint louis arch pictures

- yeezy 350 supreme louis vuitton

- gucci sling bag original price

- louis vuitton speedy 60

- lv women watch

- louis vuitton double card holder review

- supreme and louis vuitton box logo

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton new wave chain bag review

louis vuitton handbags ebay australia

louis vuitton pochette metis cherry berry

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louie outlet for more info.