Sales Tax Rate Clark County Nevada

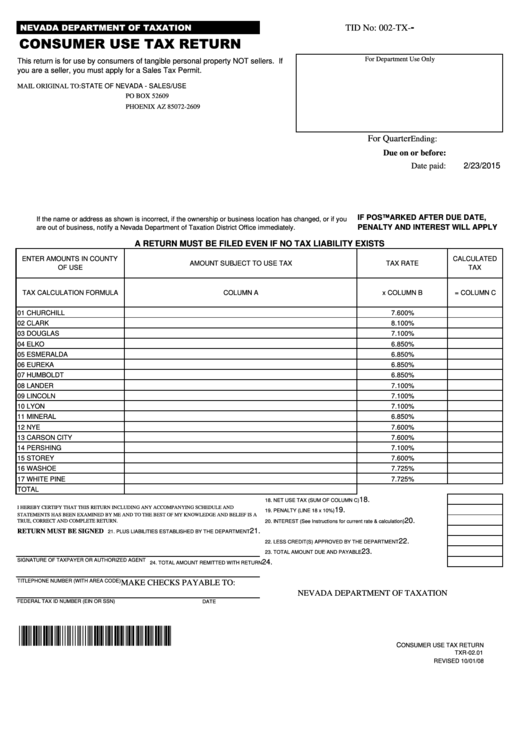

How 2020 Sales taxes are calculated for zip code 89801. The 89801, Elko, Nevada, general sales tax rate is 7.1%. The combined rate used in this calculator (7.1%) is the result of the Nevada state rate (4.6%), the 89801's county rate (2.5%). Rate variation The 89801's tax rate may change depending of …

Upon payment of all taxes and costs, the county will reconvey the real property back to the owner. The Tax Lien Sale. In most counties in Nevada, tax lien sales are handled like auctions. This article covers the basics as well as specifics for Washoe and Clark Counties. The remaining counties in Nevada will be covered in a separate article.

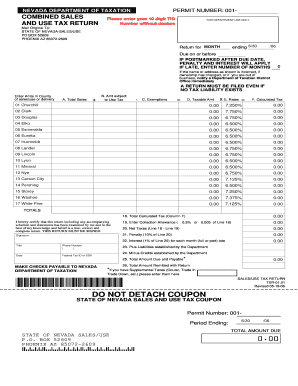

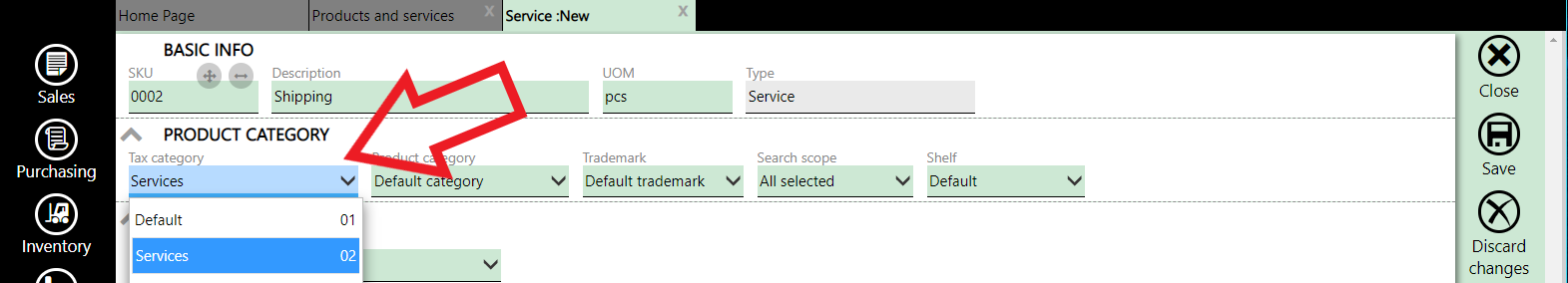

Sales Taxes Top ↑ See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual purchase price. Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. Many dealers remit sales tax payments with sales tax rate clark county nevada the title ...

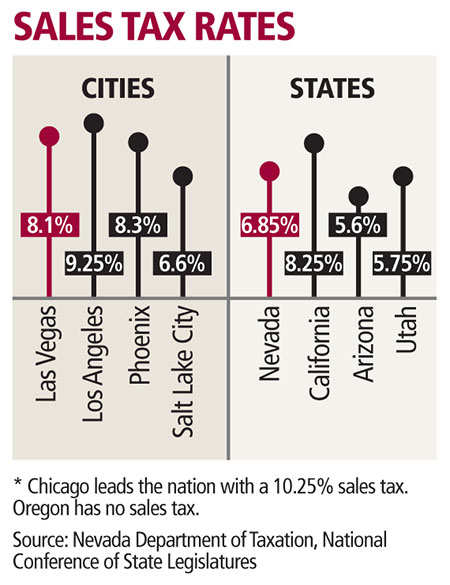

The Nevada (NV) state sales tax rate is currently 4.6%. Depending on local municipalities, the total sales tax rate clark county nevada tax rate can be as high as 8.265%. Other, local-level tax rates in the state of Nevada are quite complex compared against local-level tax rates in other states.

Nevada has 249 cities, counties, and special districts that collect a local sales tax in addition to the Nevada state sales tax.Click any locality for a full breakdown of local property taxes, or visit our Nevada sales tax calculator to lookup local rates by zip code. If you need access to a database of all Nevada local sales tax rates, visit the sales tax data page.

SALES Nevada Residence (Permanent or Temporary) Sales are taxable if they reside in Nevada Rebates: Manufacture Rebates do not affect the sales tax on the selling price of a vehicle. This is a form of payment Dealer Discounts: Dealer discounts are considered discounts and are not taxable. It reduces the selling price of the vehicle.

Nevada Sales Tax Guide for Businesses - TaxJar

Example: You live and run your business in Las Vegas, NV 89165 which has a sales tax rate of 8.10 %. You ship a product to your customer in Carson City 89701, which has a sales tax rate of 7.72 %. You would charge your customer the 7.72 % rate. How to Collect Sales Tax in Nevada if you are Not Based in NevadaThe Clark County Commission on Tuesday voted 5-2 to raise the sales tax by one-eighth of a cent sales tax rate clark county nevada to pay for education and social services, half the amount authorized by the 2019 Legislature.

Sales tax calculator for Las Vegas, Nevada, United States ...

How 2020 Sales taxes are calculated in Las Vegas. The Las Vegas, Nevada, general sales tax rate is 4.6%. Depending on the zipcode, the sales tax rate of Las Vegas may vary from 8.25% to 8.375% Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (3.65% to 3.775%). There is no city sale tax for ...RECENT POSTS:

- christmas greetings animation free downloading

- outlet louis vuitton m40473 menilmontant mm crossbody bag monogram canvas

- hobo brand purses nordstrom rac

- 6 flags st louis promo codes

- st louis cardinal spring training packages

- best louis vuitton in vegas

- louis v x supreme backpack

- louis vuitton babylone pm leather bag

- ebay used purses and handbags

- best 70 inch tv black friday deal

- lv eva monogram

- montblanc wallets at low price

- lv bags used for sale

- louis vuitton bags real vs fake

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton chain louise clutch

red and white lv supreme hoodie

louis vuitton pochette mini line

vintage fanny pack louis vuitton

wholesale women's bags china wholesale

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton keepall fiber optic for more info.