Sales Tax Rate In Clark County Nevada 2018

That will raise Clark County’s sales tax rate to 8.375 percent and generate $54 million. The commission will solicit applications from government agencies and other groups who’d like a portion ...

How 2020 Sales taxes are calculated for zip code 89801. The 89801, Elko, Nevada, general sales tax rate is 7.1%. The combined rate used in this calculator (7.1%) is the result of the Nevada state rate (4.6%), the 89801's county rate (2.5%). Rate variation The 89801's tax rate may change depending of …

Nevada Gaming Control Board : License Fees and Tax Rate ...

Feb 06, 2020 · The tax rate for all admission sales tax rate in clark county nevada 2018 charges collected is 9%. ... Authorizes the holder to, from Nevada, engage in the business of operating interactive gaming. The initial fee is $500,000, which is for two years. The annual fee thereafter is $250,000 (NRS 463.765).Clark County, NV

Future Due Dates. Facebook Twitter Instagram Youtube NextDoor. Apply for a Business sales tax rate in clark county nevada 2018 License; Doing Business with Clark CountyJun 10, 2019 · Las Vegas has generated less funding in marijuana licensing and application fees than Clark County, coming to a total of $7,978,867 since the start of fiscal year 2015.

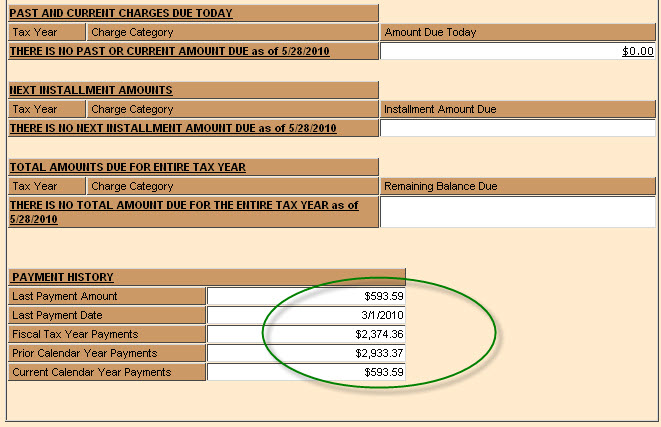

Clark County Treasurer | Official Site

Office of the County Treasurer: Office Hours 7:30 a.m.- 5:30 p.m. 500 S Grand Central Pkwy 1st Floor : Monday - Thursday (Except Holidays) Las Vegas NV 89106 : Ph. (702) 455-4323 Fax (702) 455-5969 : Mailing Address : Physical Address : Office of the County Treasurer : Office of the County Treasurer : 500 S Grand Central Pkwy : 500 S Grand ...Clark County Nevada Property Taxes - 2020

The median property tax in Clark County, Nevada is $1,841 per year for a home worth the median value of $257,300. Clark County collects, on average, 0.72% of a property's assessed fair market value as property tax. Clark County has one of the highest median property taxes in the United States, and is ranked 546th of the 3143 counties in order of median property taxes.The Nevada (NV) state sales tax rate is currently 4.6%. Depending on local municipalities, the total tax rate can be as high as 8.265%. Other, local-level tax rates in the state of Nevada sales tax rate in clark county nevada 2018 are quite complex compared against local-level tax rates in other states.

Nevada County, CA Sales Tax Rate

Jul 01, 2020 · The latest sales tax rate for Nevada County, CA. This rate includes any state, county, city, and local sales taxes. 2019 rates included for use while preparing your income tax deduction. louis vuitton chain bag whiteRECENT POSTS:

- louis vuitton heart bag black

- plus size women's coats on sale

- when do st louis cardinals 2020 tickets go on sale

- monogrammed backpack kids

- how tell authentic louis vuitton

- louis vuitton graffiti keepall

- louis vuitton slides fur

- faux gucci crossbody bag images

- st louis furniture outlet stores

- how to spot fake louis vuitton monogram wallet

- black and white louis vuitton women shoes

- saint louis cardinals game channel

- gucci soho leather disco bag colors

- history of depaul hospital st louis motor

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

inside a real louis vuitton purse

zippered cosmetic bag pattern free

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis philippe of france overthrown for more info.