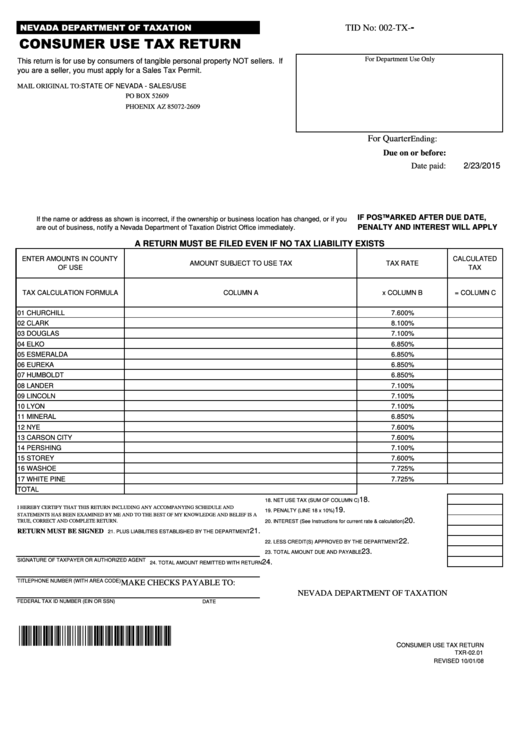

State Of Nevada Sales Tax Rates By County

.jpg)

Sales tax on cars and vehicles in Nevada

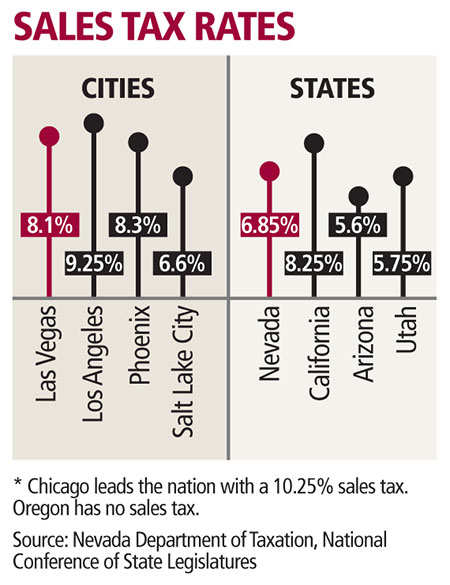

Nevada collects a 8.1% state sales tax rate on the purchase of all vehicles. Some dealerships may also charge a 149 dollar documentary fee. In addition to taxes, car purchases in Nevada may be subject to …Welcome to the Nevada Tax Center

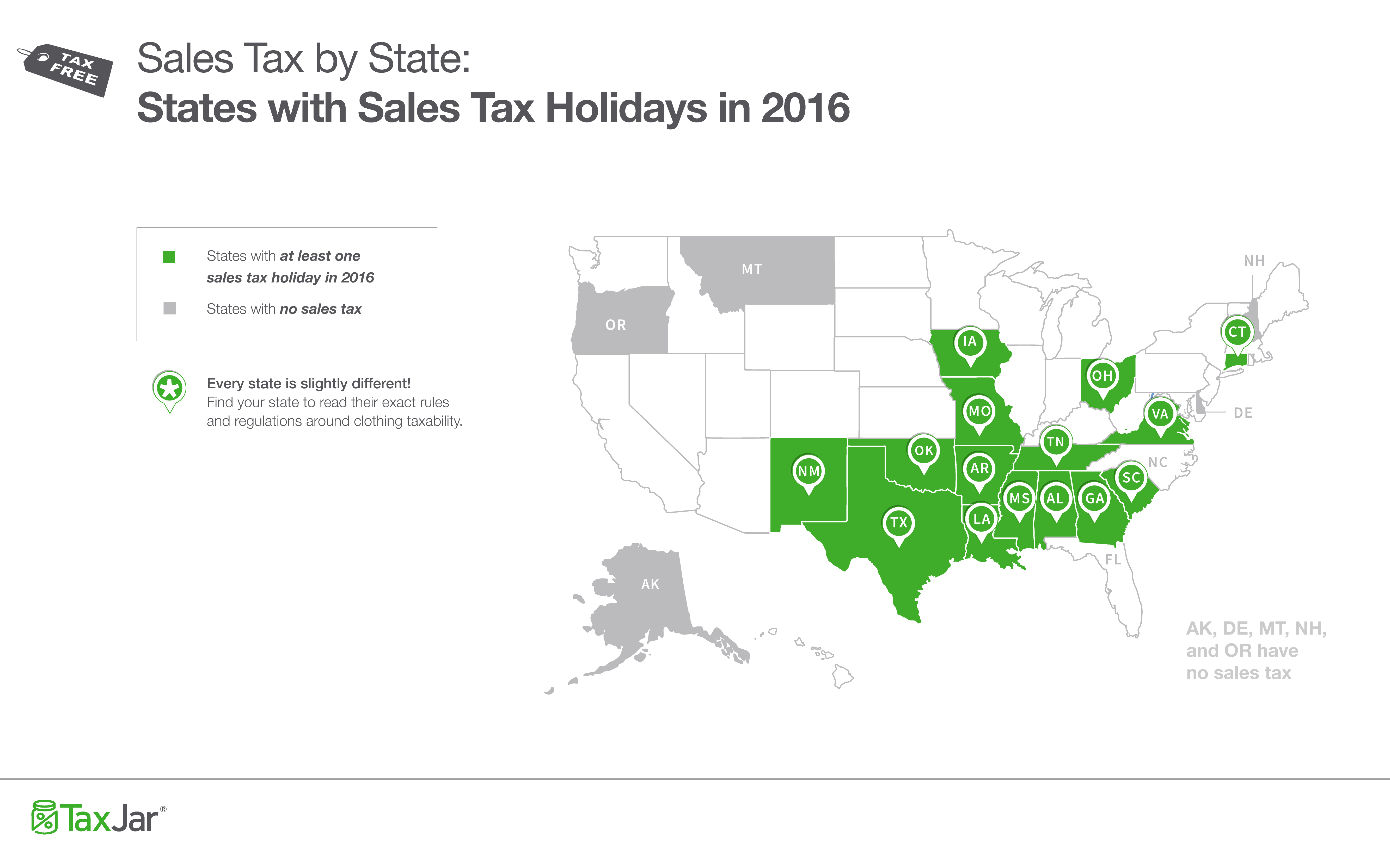

Jan 01, 2020 · The Department is now accepting credit card payments in Nevada Tax (OLT). Click Here for details.; NEW! Click here to schedule an appointment; Clark County Tax Rate Increase - Effective …Sales and Use Tax Abatement - state of nevada sales tax rates by county Sales and use tax abatement on qualified capital equipment purchases, with reductions in the rate to as low as 2%. Modified Business Tax Abatement - An abatement of 50 percent of the 1.475% rate …

Dealer Vehicle Sales Outside of Nevada

Sales Taxes. An out-of-state dealer may or may not collect sales tax. See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates. Rates vary by county. Many dealers remit sales tax …Nevada Gasoline and Fuel Taxes for 2020

Nevada Aviation Fuel Tax . In Nevada, Aviation Fuel is subject to a state excise tax of $0.02 per gallon; counties are able to impose county option taxes up to 8 cents per gallon. Point of Taxation: Sales made to end user or retailer. Sales between licensed suppliers are state of nevada sales tax rates by county tax …Nevada The state of Nevada became a full member of Streamlined Sales Tax on April 1, 2008. Membership Petition Certificate of Compliance Annual Recertification Letter Taxability Matrix. …

Below, we list the state tax rate, although your city or county government may add its own sales tax as well. ... Nevada: $33: $8: $985: $29.25: No limit: Governmental Services Tax based on vehicle value: ... Varies by county, plus 0.3% motor vehicle sales/use tax…

Nevada Gaming Control Board : License Fees and Tax Rate ...

Feb 06, 2020 · The tax rate for all admission charges collected is 9%. ... Authorizes the holder to manufacture, assemble or produce an interactive gaming system for use and play in the State of Nevada …Nevada Sales Tax Guide for Businesses - TaxJar

The sales tax rate you collect in Nevada depends on where your product is headed, as Nevada is a destination-based state. How to Collect Sales Tax in Nevada if you are Based in Nevada. Nevada is an destination-based sales tax state. So if you live in Nevada, collecting state of nevada sales tax rates by county sales tax … louis vuitton geldbeutel herren sales tax rateRECENT POSTS:

- louis vuitton dupes on amazon 2020 fall

- lv kirigami

- lv swimsuit 2020

- christian dior vintage trotter handbag

- tan crossbody bag outfits for women

- menards 11 sale schedule 2019

- lv neverfull mm bag shaper

- lemp mansion restaurant ' inn saint louis

- lv capucines pm vs bb

- louis vuitton paris bag charm

- custom air force 1 louis vuitton women's

- neverfull gm work bag

- coach outlet bags online

- lv rings sale

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton speedy nano monogram ราคา

free sewing pattern tote bag with zipper

women's business leather tote bags

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the did it snow in st louis today for more info.