State Sales Tax For Las Vegas Nevada

When it comes to taxes, Nevada is a great place to retire ...

Yes, Nevada is very tax-friendly for retirees. Since Nevada does not have a state income tax, any income you receive during retirement will not be taxed at the state level. This includes income from Social Security and income from retirement accounts. Additionally, the average effective property tax rate in Nevada is just 0.96%. The average ...Jun 30, 2009 · The sales tax rate in Las Vegas and Clark County on Wednesday will jump to 8.1 percent as the state sales tax for las vegas nevada result of a 0.35 percentage point increase vetoed by …

Jul 17, 2017 · The state of Nevada charges $15.00 per application for a sales tax permit. Other business registration fees may apply. Contact each state’s individual department of revenue for more about registering your business.

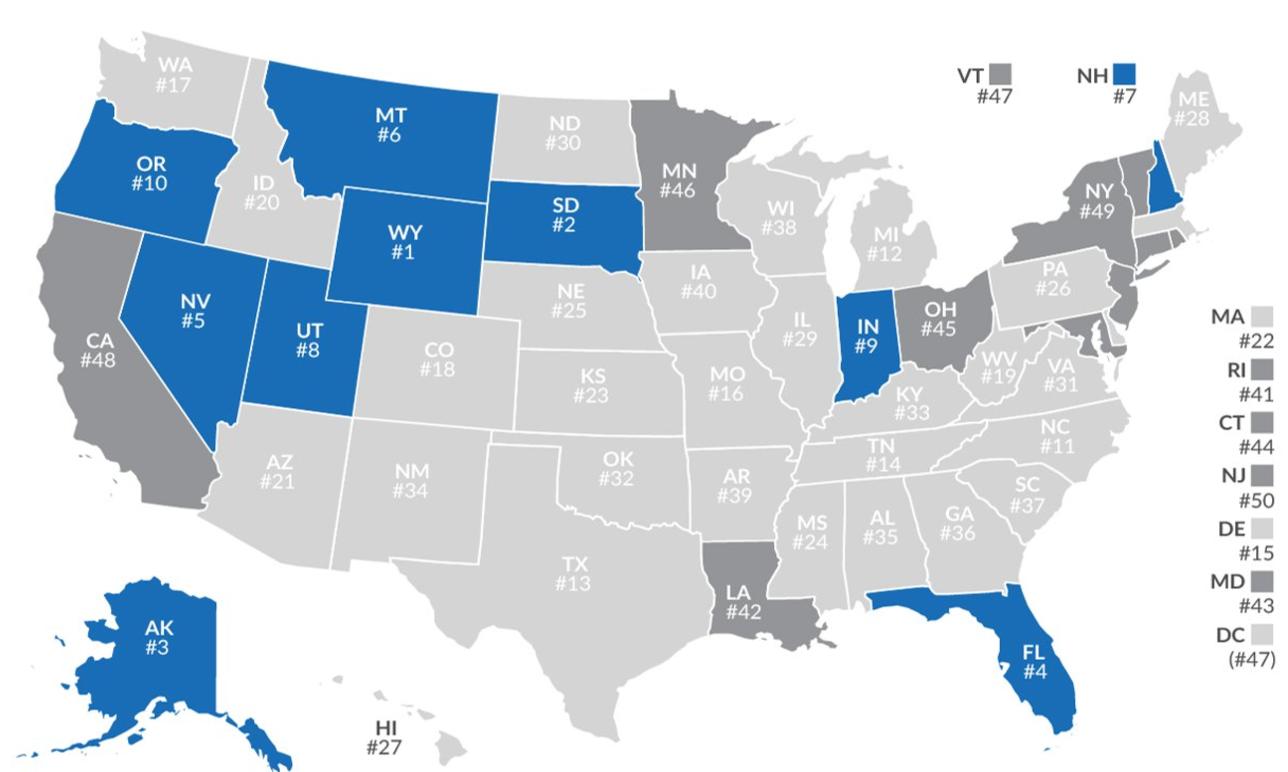

12 states that have either no income or sales taxes | Newsday

While tourists come to Nevada to gamble and experience Las Vegas, residents pay no personal income tax, and the state offers no corporate tax, no franchise tax, and no inventory tax. The Silver ...Buying gold and silver in Nevada | 0

TAXES IN NEVADA. The rate of taxation in Nevada depends entirely on where you are. The lowest you should expect to pay is just under 7%, while the highest is just over 8%. The actual state tax is 6.85%, and it varies by county as follows: Las Vegas — 8.1%; Clark County — 8.1%; Henderson — 8.1%; Reno — 7.725%; Carson state sales tax for las vegas nevada City — 7.60% ...Effective July 1, 2009, Clark County assesses a 8.10% sales and use tax, exempting food for home consumption and prescribed medical goods. Nevada is proud to have the lowest overall tax rate of any state in the nation.

Under the new rules, state sales tax for las vegas nevada remote sellers must register with the state and collect Nevada sales tax once their sales in the previous or current calendar year exceed: $100,000 in sales in Nevada, or; 200 separate transactions for delivery into the state.

Below is a list of state & local taxes and fees on monthly cell phone service. The federal tax rate on wireless service (called the USF, or Universal Service Fund) is 6.64%. You can add the federal tax rate of 6.64% to the tax rate of your state to find out what percentage you are paying in taxes.

Nevada Tax Benefits - See How Much Money You'll Save ...

Oct 21, 2020 · Sales Tax In Las Vegas, Henderson, and N. Las Vegas is 8.375%; Nevada State Sales Tax Rate is 4.6% added to the Clark County rate of 3.775% equals 8.375%. Other counties are usually lower. No Sales Tax on food, candy, medical or medicine for people; The Downside Of Nevada’s Cost of Living. The state’s tax benefits are among the best in the ...RECENT POSTS:

- louis vuitton pochette monogram mm/gm cerise lining

- louis vuitton wallets for cheap

- oakley knockoff sunglasses wholesale

- longchamp tote bag medium sale

- louis vuitton palm springs mini black and red

- st louis strength academy

- ladies black tennis shoes on sale

- louis vuitton noé bb vintage

- top 10 designer bags for workers

- men's louis vuitton slides

- gucci belt dupes amazon

- lv box bag white

- louis vuitton crossbody bag selfridges

- louis vuitton mini bag

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton wallet price germany price

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton receipt template pdf free for more info.